[ad_1]

IBM Corp.’s acquisition of HashiCorp Inc. presents a pivotal second for multicloud and hybrid cloud deployments.

With a give attention to aligning missions and accelerating development, IBM intends to function HashiCorp independently, akin to the Crimson Hat mannequin. Synergies in product choices, significantly Terraform and Vault, promise enhanced cloud operations. Financially, elevated funding in R&D and cloud-hosted options is anticipated, leveraging IBM’s in depth buyer base. Licensing discussions trace at potential changes, reflecting trade tendencies.

Amidst integration challenges, preserving HashiCorp’s tradition stays paramount. With implications for the cloud working mannequin panorama, together with OpenShift versus VMware, the acquisition signifies a transformative section for cloud infrastructure suppliers.

The acquisition of HashiCorp by IBM is among the finest outcomes for HashiCorp and multicloud and hybrid cloud deployments. Ii will result in aligning missions and the potential for accelerating development of each the HashiCorp portfolio and adjoining applied sciences from IBM and Crimson Hat. IBM has said that it plans to observe the Crimson Hat acquisition mannequin, permitting it to function a lot of its R&D and product capabilities independently of the opposite organizations in IBM. There was some rapid rationalization of merchandise on the storage aspect, with the Crimson Hat storage applied sciences, similar to Ceph, transferring to IBM storage.

In a briefing, IBM introduced that it goals to speed up and broaden HashiCorp’s mission by investing in R&D and leveraging IBM’s go-to-market distribution and channel ecosystem. This brings us to the primary set of synergies and rationalization. We consider that IBM will rationalize HashiCorp’s back-office operations instantly after the acquisition closes.

It will embrace some reorganization of the gross sales pressure as IBM and Crimson Hat have spent a substantial time discovering the synergies within the promoting movement, that are much more complementary between HashiCorp and Crimson Hat than IBM correct. Nevertheless, it’s this work that IBM and Crimson Hat have put in on the nonproduct aspect that we consider will make this acquisition accretive for IBM.

Product synergies

On the product aspect of the home, we see a ton of synergies and little or no overlap within the product units, and the place there may be overlap, it is going to be an opportunity to convey two merchandise or applied sciences collectively to construct a greater one or rationalize. The principle product prospects are utilizing is Terraform, which is excellent for day zero operations, these operations for getting companies up and operating, configuring cloud companies, and guaranteeing that configurations don’t drift.

That is extremely complementary and infrequently leveraged by Crimson Hat’s Ansible for automation or day-one operation, and day-two operations are supplied by the IBM portfolio of observability platforms, similar to Instana, Turbonomic and Apptio. The following large product from HashiCorp is Vault, which offers secrets and techniques administration capabilities.

Monetary alternatives

The customarily-cited advantages of the acquisition embrace elevated attain and belief with massive corporations and the power to put money into HashiCorp product innovation at a fee larger than its present R&D. 12 months over yr, HashiCorp grew its R&D expense by 12%, to $222.6 million, its gross sales and advertising and marketing bills rose by 4%, to $369.2 million, and whole working expense grew 6%, to $728.72 million for fiscal yr 2024.

What’s necessary to notice is that these are the place they intend to extend funding in R&D and discover synergies and financial savings within the mixed entity that may considerably cut back the $506.2 million working expense excluding R&D from FY 2024. What can also be very attention-grabbing and a spot the place there are synergies between the Crimson Hat and HashiCorp fashions is HashiCorp’s transition to cloud-hosted options and help as a development engine. With license gross sales solely rising yearly at 5% and the help companies rising at 17%, the cloud-hosted grew 38% and eclipsed license income for the primary time.

OpenShift + HashiCorp + Ansible = cloud working mannequin chief

All three corporations have constructed sturdy relationships with the hyperscale cloud suppliers. HashiCorp has been seen as a strategy to improve hyperscale cloud consumption by making it simpler to configure and deploy cloud-based companies and construct cloud-native functions. Each the Terraform and Vault are seen as early investments in cloud infrastructure, with Boundary being the privileged entry administration providing to supply identity-based person entry to hosts and companies throughout environments, which generally consists of on-premies and cloud deployments.

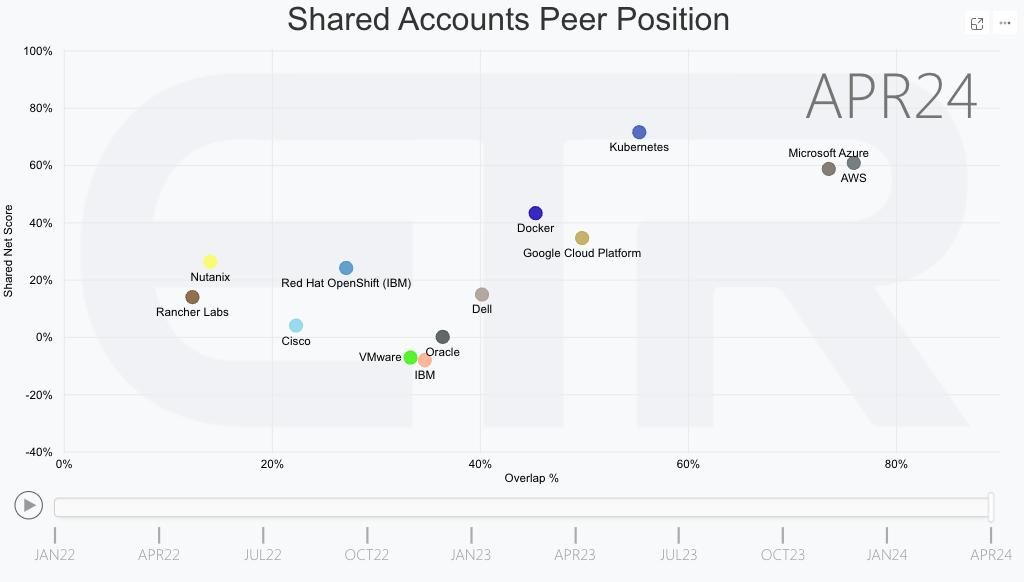

Analyzing knowledge from our associate Enterprise Know-how Analysis we are able to take a look at the Shared Accounts Peer Place for HashiCorp’s 291 prospects that present up within the newest April 2024 monitoring knowledge. Whereas the share overlap will increase throughout the hyperscale clouds, similar to AWS, GCP, Azure and Oracle, the shared internet rating decreases throughout the board. Nevertheless, we additionally see a major shared account and shared internet rating spending momentum affinity for AWS, Azure, GCP, Docker and Kubernetes. IBM, VMware and Oracle have the least shared spending momentum by way of shared Web Rating inside HashiCorp accounts.

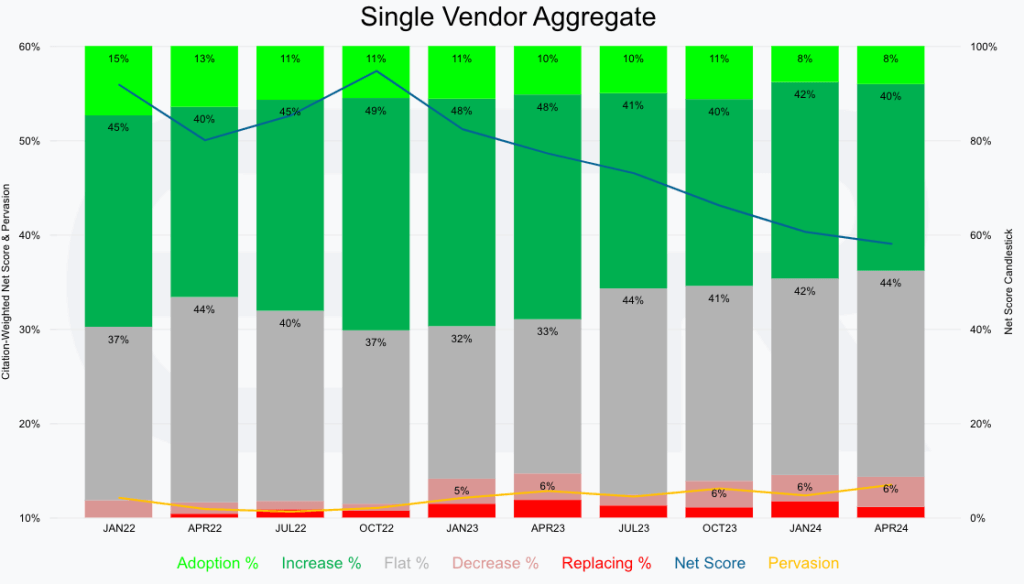

That is indicative if you take a look at HashiCorp individually from a Web Rating and pervasion throughout the greater than 1,700 organizations sampled by ETR. On this determine under, we see that development inside HashiCorp accounts is has slowed during the last two years, though on the similar pervasion throughout the pattern has stayed comparatively the identical. That implies that as soon as HashiCorp is in an account, it is rather sticky however might not develop quick. That is spelled out by a strong Web Rating of 39% spending momentum within the newest pattern from April 2024.

Within the April 26 analyst dialogue with David McJannet, chief govt of HashiCorp, and Rob Thomas, senior vp of software program and chief industrial officer at IBM, it was famous that IBM boasts relationships with greater than 2,000 Fortune 2000 industrial prospects. In contrast with HashiCorp’s 500, the acquisition guarantees larger entry to a broader buyer base and enhanced geographic scale.

Elephant within the room: licensing

A necessary facet of the dialogue revolves round licensing, with inquiries raised about potential adjustments post-acquisition. In that very same April 26 analyst dialogue with David McJannet and Rob Thomas, the importance of open-source licensing fashions in enabling enterprise operations was acknowledged. They level to precedents set by different trade gamers altering from absolutely open licensing fashions to extra restrictive personal licensing. McJannet highlighted the necessity for rational licensing choices to help the evolving market panorama.

Though no concrete bulletins are made through the name, the executives point out a nuanced understanding of the licensing dynamics, hinting at attainable changes aligned with trade tendencies and enterprise imperatives. Terraform was a Mozilla Public License or MLP earlier than going to a enterprise supply license to unravel for the weak “copy-left” permissibility of MLP

Having examined this for corporations, what McJannet stated about percentages of contributions out of your group versus these from outdoors organizations is important. When organizations are producing greater than 95% of the code, ignoring documentation contributions, it’s a must to ask your self in case you actually are an open-source or a industrial software program firm with a really permissive “freemium” mannequin.

That being stated, you possibly can have a group license that has exclusions. This normally means restrictions round different organizations making the software program obtainable for a distributed software program product, a software-as-a-service, a platform-as-a-service, an infrastructure-as-a-service or different comparable on-line service that competes with any services or products the originating firm provides.

The trick is that in case your total product is licensed on this method, you might be saying it’s industrial software program with a freemium mannequin to strive it or for organizations utilizing it as meant internally. This may be limiting from a complete addressable market perspective for the corporate, with massive corporations rolling their very own and hiring their maintainers, however that is normally not a difficulty.

Put up-acquisition integration

One piece to look at is how the tradition of HashiCorp is preserved through the integration time-frame post-acquisition closure. Having been acquired a number of instances and been part of making acquisitions, I consider it’s a super-important time for setting the right cultural expectations. There isn’t a strategy to protect all of the cultural elements of the beforehand unbiased firm.

Our perspective

Main into Crimson Hat Summit and Ansiblefest this week, we anticipate to listen to nothing about this formally. What can be very attention-grabbing are the hallway conversations with buyer and their views on what this may imply for them. We consider that IBM, Crimson Hat and HashiCorp have an opportunity to proceed rising right into a formidable possibility when organizations are figuring out their cloud working mannequin with the adjustments happening at VMware by Broadcom.

ETR notes that “among the many 850 prospects citing a spending intent on VMware on this sector, Crimson Hat has an virtually 29% shared buyer overlap proportion, whereas HashiCorp has about 19% share in that very same respondent pattern. Nevertheless, in line with ETR’s April 26 weblog submit, HashiCorp’s spending intentions are materially greater amongst VMware prospects than they’re with Crimson Hat, with a 43% shared Web Rating versus 34% for Crimson Hat. Each are wholesome Web Rating ranges, however HashiCorp’s 40%+ shared Web Rating exhibits explicit power and demonstrates the chance to take any share on this market that turns into obtainable as a result of VMware acquisition by Broadcom and extra channel partnership turmoil that has occurred.

Though we predict it’s early days for replatforming from ESX to OpenShift Virtualization by way of the KubeVirt venture, we anticipate this to proceed to be a thorn in VMware’s aspect. However we anticipate some very massive prospects to be on show this coming week on the Crimson Hat Summit. One of many items that was lacking for Crimson Hat and IBM was the day zero operations. And HashiCorp completely plugs that gap and extra. IBM has actually centered on turning into the software program and companies cloud-operating-model arms seller throughout all clouds, be it hyperscale, hybrid or personal.

We’re in “wait and see” mode concerning licensing, and we might say that almost all HashiCorp prospects can be, too. We see either side of the argument however do anticipate some adjustments. We doubt that Terraform will return for MLP or to an Apache license that will be required for entry into the Cloud Native Computing Basis. That being stated, we consider there can be adjustments right here, and a few elements might return to a extra permissive open-source license, simply not every thing.

Here’s a video of us discussing the HashiCorp acquisition throughout a current AnalystANGLE through the IBM: Future-Prepared Storage launch broadcast:

Picture: Adobe Inventory

Your vote of help is necessary to us and it helps us preserve the content material FREE.

One click on under helps our mission to supply free, deep, and related content material.

Be a part of our group on YouTube

Be a part of the group that features greater than 15,000 #CubeAlumni specialists, together with Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and lots of extra luminaries and specialists.

THANK YOU

[ad_2]