[ad_1]

If you and your associate resolve to get married, you comply with be with each other “for higher, for worse, for richer, for poorer, in illness and in well being,” however what about in debt?

One newlywed lately shared on Reddit that the honeymoon stage didn’t final very lengthy together with his spouse as a result of she dropped a bombshell about her funds on him proper after their wedding ceremony. Now, he’s questioning what one of the best plan of action will probably be for his or her relationship. Under, you’ll discover the complete story, in addition to a dialog with Julia Rodgers, Esq., CEO of Hey Prenup.

Proper after getting married, this man’s spouse dropped a bombshell on him concerning her funds

Picture credit: RDNE Inventory challenge / pexels (not the precise picture)

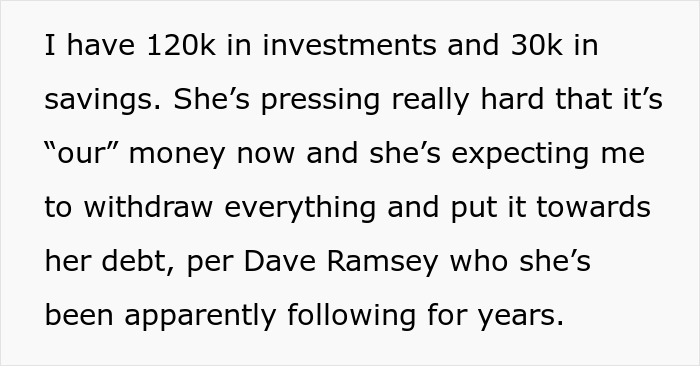

Now, he’s questioning what one of the best plan of action can be

Picture credit: Karolina Grabowska / pexels (not the precise picture)

Picture credit: Ready_Cash9333

Later, the person supplied some background info on the connection

“By discussing funds early on, you prioritize speaking about any variations in cash administration kinds and start to create a plan to your shared monetary future”

To achieve extra perception on this example, we reached out to Julia Rodgers, Esq., CEO of Hey Prenup. Julia was form sufficient to have a chat with Bored Panda and talk about when the appropriate time to begin speaking about funds with a associate is.

“{Couples} ought to begin discussing funds as early as potential of their relationship, and definitely earlier than making any main life commitments like transferring in collectively or getting engaged,” Julia shared. “By speaking about cash early on, {couples} are capable of perceive one another’s monetary habits and values, making manner for higher communication.”

“Transparency is essential to good communication in a relationship. By discussing funds early on, you prioritize speaking about any variations in cash administration kinds and start to create a plan to your shared monetary future,” she continued.

In case you are transferring in with a associate or beginning to share monetary duties, Julia says it could be useful to plan a “cash date” as soon as a month to sit down down and talk about your price range, objectives, and debt administration. “A daily cadence may help keep away from any gaps in communication,” she shared.

In terms of coping with money owed, Julia says being is crucial. “Hiding it is going to erode belief,” she advised Bored Panda. “The Reddit submit highlights the significance of full disclosure, because the poster felt blindsided by his spouse’s debt revelation.”

Picture credit: Mikhail Nilov / pexels (not the precise picture)

“Being open about monetary issues may help you avoid any surprises and guarantee equity for each spouses”

“By overtly discussing debt and dealing collectively in direction of a debt administration plan collectively, {couples} can use this vulnerability to strengthen their bond, fairly than doing what this spouse did – lie, after which demand their associate pay for this debt, the evening after their wedding ceremony,” the knowledgeable continued. “This underscores the significance of a prenup, which forces clear boundaries and expectations concerning monetary choices throughout the relationship.”

Julia additionally famous that money owed are certain to affect each companions after they get married. “Regardless that marrying into debt doesn’t robotically make it your downside, it is going to have an effect on the way you handle your funds as a pair,” she defined. “Cash performs a giant function in our lives – it determines the place we stay, how usually we are able to splurge on a trip, and extra. Similar to the Reddit submit, deception like this could destroy a relationship.”

Occasion of a divorce, Julia says judges usually have the ability to separate money owed between each companions, no matter whether or not it was racked up earlier than or in the course of the marriage. “Legal guidelines range state by state, however this example might be scary for {couples} who entered marriage with out a prenup, as a result of they are going to be topic to state divorce regulation, and so they could not like the result,” she shared.

Julia additionally identified that this could embrace numerous sorts of debt, similar to bank card debt, enterprise debt, and pupil loans, which most millennials and Gen Zers have. “For instance, if one associate has important pupil mortgage debt or bank card debt (with out a prenup), it may develop into a shared duty in a divorce,” she warns. “Take the Reddit state of affairs, as an example – the newlywed was staring down the barrel of probably sharing the burden of his new spouse’s $160k debt.”

The takeaway ought to be that it’s essential to put all of your playing cards on the desk and speak about cash early on in your relationship. “Authorized safeguards like prenuptial agreements enable {couples} to speak about cash early and sometimes, and resolve for themselves how property or debt ought to be managed,” Julia famous. “Being open about monetary issues, not like the spouse on this Reddit submit, may help you avoid any surprises and guarantee equity for each spouses.”

Picture credit: Ketut Subiyanto / pexels (not the precise picture)

“I can not see how, after this degree of deception, the connection may progress ahead in a wholesome method”

Should you plan on getting married whilst you or your future partner has important debt, Julia says that open communication and proactive planning are key for the success of the connection. “You have to have sincere discussions concerning the debt and the way it would possibly affect each of your monetary futures,” she defined.

And as for whether or not or not it’s a foul thought to begin a wedding below circumstances like this, Julia notes that it’s related whether or not or not your associate was forthcoming concerning the debt. “In the event that they tried to cover it, this can be a main purple flag that may very well be indicative of larger points,” the knowledgeable says. “On this state of affairs, the spouse lied about debt till after the couple was married, after which demanded her new husband pay for her debt. I can not see how, after this degree of deception, the connection may progress ahead in a wholesome method.”

“The query that anybody within the husband’s state of affairs has to ask is: In case your associate has important debt, are they receptive to making a plan to mitigate the debt?” Julia advised Bored Panda. “Are they prepared to work collectively to handle the monetary challenges, or do they appear resistant or avoidant or anticipate you to only deal with it for them?”

“It’s important to ask your self these questions, as a result of how they reply to this example can present helpful perception into their strategy to working as a workforce in different elements of life,” the knowledgeable identified. “It’s clear that the spouse on this Reddit submit was not involved in working as a workforce.”

Picture credit: Tima Miroshnichenko / pexels (not the precise picture)

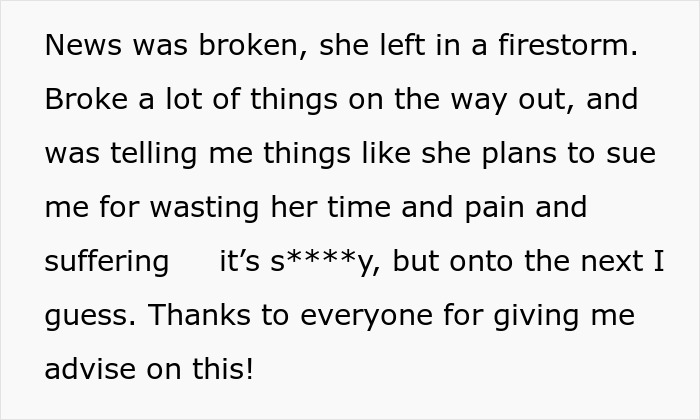

Readers had been fast to share their ideas and supply recommendation for the person

Later, the OP supplied an replace on how he’s determined to deal with the state of affairs

[ad_2]