[ad_1]

Heading into the second half of 2023, some traders felt that the semiconductor runup final summer season was a harbinger for a broader tech rally. That thesis proved prescient and rewarded managers who took on threat on the time with main companies in semiconductors, safety and enterprise software program. The query is, the place will we go from right here?

On this Breaking Evaluation, we welcome again Ivana Delevska, founder and chief funding officer at Spear Make investments, Nasdaq SPRX. Some have in contrast SPRX to a miniature model of Cathie Wooden’s ARKK fund. Nonetheless SPRX is extra sector-agnostic, the place Delevska focuses extra broadly on development themes reminiscent of her present emphasis on cybersecurity, semiconductors and enterprise software program.

Final time we Ivana on was August of 2023 and we requested her about Nvidia Corp. Right here’s what she stated:

Effectively, David, we nonetheless love Nvidia going into the subsequent cycle. We imagine we’re within the early innings of knowledge middle spending. So that you’re simply beginning to see corporations like Microsoft Meta and Google broaden their capex budgets going into subsequent 12 months. So we imagine Nvidia goes to profit from that. –Ivana Delevska, Aug. 4, 2024, on Breaking Evaluation

That was fairly forward-thinking and whereas it’s definitely not greenback for greenback, final quarter Nvidia’s income equated to about half of the capex spend from the hyperscalers – so there’s a correlation there.

Premise has paid off for Spear thus far

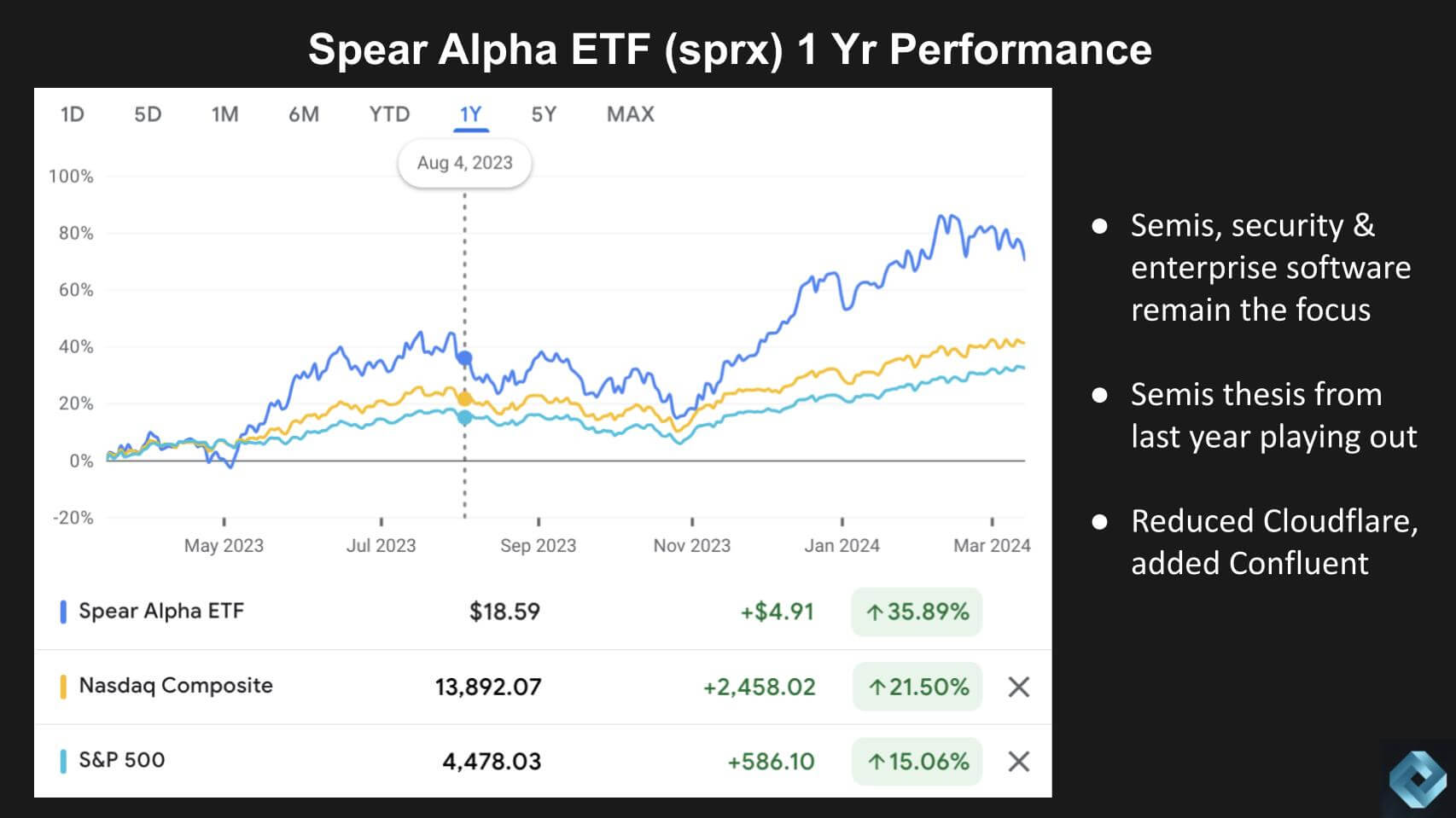

Delevska made the earlier assertion on Aug. 4 and you’ll see under her funds efficiency relative to the Nasdaq and S&P 500.

Ivana advised us on the time that she was fully invested and fairly “threat on,” organising an excellent run within the second half and she or he was proper on… the Nvidia commerce has powered a lot of high-flying corporations past the Magnificent 7.

Q1. So the query is: “Now what?” How are you occupied with the market going ahead? The cloud hyperscalers have been loading up on GPUs, as is Meta Platform to coach Llama 2 and Llama 3. Cathie Wooden trimmed her Nvidia holdings in 2023 and missed the latest transfer and different traders seem like displaying issues in regards to the inflated nature of Nvidia’s inventory and potential overbuying of GPUs, though Piper upped its goal worth on Nvidia Friday. You’ve executed very properly with the inventory, what are your ideas going ahead? Are you taking some income, holding agency? Trying to purchase pullbacks what’s your pondering?

Effectively, Dave, we imagine we’re nonetheless within the early innings of this tech cycle and we simply scratched the floor of the GPU alternative. So we nonetheless see much more upside…a number of years truly of upside right here. In the event you have a look at the earnings estimates for Nvidia, whereas they’ve elevated for the present 12 months, should you look out to 2025, 2026 and 2027, the Avenue is assuming lower than 20% CAGR within the earnings for the info middle phase versus the prior cycle, we noticed over 40% CAGR for information middle. So we nonetheless suppose that the Avenue is underestimating the earnings potential. In the event you have a look at the valuation, it truly appears fairly affordable. Nvidia is buying and selling near the center to the underside of the EBIT to EBITDA vary on a one-year ahead foundation. So that is actually what we comply with carefully to evaluate whether or not we’re on the peak of the cycle or we’re in the course of the cycle and proper now it appears extra like we’re nearer to the center or the start fairly than the height.

Q1a. Many individuals are frightened about overbuying GPUs. How do you concentrate on the sturdiness of those large capex investments from the hyperscalers?

In the event you hearken to how they’re speaking about constructing out these GPU clusters, it’s not essentially a onetime funding. That is an ongoing funding that will likely be wanted by the hyperscalers and enterprises. So the massive ones have actually already gotten a headstart. Like Meta is likely one of the ones that’s probably the most closely invested in GPUs, however there was only a weblog publish the opposite day in regards to the new cluster that they’re constructing and you’ll, simply by studying that, you may see that this isn’t a onetime funding. It’s one thing that will likely be ongoing as new fashions come to market and as inference and functions come to market. So I believe again to my prior level, you actually are seeing how that is just the start.

Q1b. What about this notion of coaching being a shot length cycle versus inference, which is extra ongoing. Many individuals count on that Nvidia may have quite a lot of competitors for inference and since its GPUs are so costly will probably be challenged in that area. However Jensen on the final name stated that inference was no less than 40% of Nvidia’s enterprise. How do you see it?

I believe the markets misunderstand. Individuals suppose that mannequin coaching is a onetime factor after which it’s like OK, you’re executed, you’ve educated the mannequin, shifting on to inference. Mannequin coaching is definitely an ongoing course of. So the brand new info you’re getting from the inferencing, it’s essential feed it again to the mannequin and practice the mannequin and it’s essential continually improve the fashions, proper? So I believe that goes again to the core of the misunderstanding of how this isn’t a onetime funding that must be made however an ongoing factor the place you’re working the functions which provides you much more information to feed the fashions with.

Spear holdings: a concentrate on semis, cyber and enterprise software program

Let’s check out the Spear portfolio.

Nvidia’s runup has made it the No. 1 holding. Superior Micro Gadgets Inc. has bumped up on the leaderboard and Marvell Expertise Inc. rounds out the highest holdings in semis. Spear additionally has taken on publicity in cybersecurity with Zscaler Inc., SentinelOne Inc. and CrowdStrike Holdings Inc.; and another enterprise software program names that we’ve talked about earlier than reminiscent of Snowflake Inc., Confluent Inc. is comparatively new and Shopify Inc. and HubSpot Inc. spherical out the highest 10.

We already talked about Nvidia. We’ve some survey information later the place we’ve plotted many of those names, so let’s maintain this at a excessive degree for now. The righthand facet of this graphic is a bit dated however nonetheless exhibits Spear’s common strategy when it comes to sectors.

Q2. Ivana, how are you occupied with your portfolio combine after which we are able to get into among the names in additional element.

We nonetheless see upside in {hardware}. So we nonetheless have a big place within the corporations that you just talked about. We do as properly have a really massive publicity to cybersecurity. What’s been taking place this 12 months is we went towards the tip of final 12 months, folks determined to take much more threat they usually gravitated towards the higher-valuation software program shares that ran up considerably into yeare-end. Nonetheless, what we’ve seen this 12 months is a fairly important pullback. So after we’re searching for new alternatives, it’s actually the software program facet the place we’re discovering rather a lot occurring, particularly publish this incomes season whenever you had many shares simply get utterly destroyed on earnings.

So despite the fact that from high-level perspective, it looks as if the Nasdaq is close to its highs, and the indices are close to close to highs, should you look underneath the hood, truly quite a lot of shares have actually bought off from the height. All of it goes again to rates of interest. Persons are nervous now in regards to the Fed and after they’re precisely going to chop and normally this type of runup in rates of interest creates excellent entry factors for expertise. So whereas we nonetheless like {hardware}, I believe that’s a nonetheless great spot to have allocation going into 2025, there are quite a lot of idiosyncratic alternatives right here publish a few of these earnings hits that we’ve seen.

The affect of AI on investing methods

Let’s discuss in regards to the AI impact and the way to consider that.

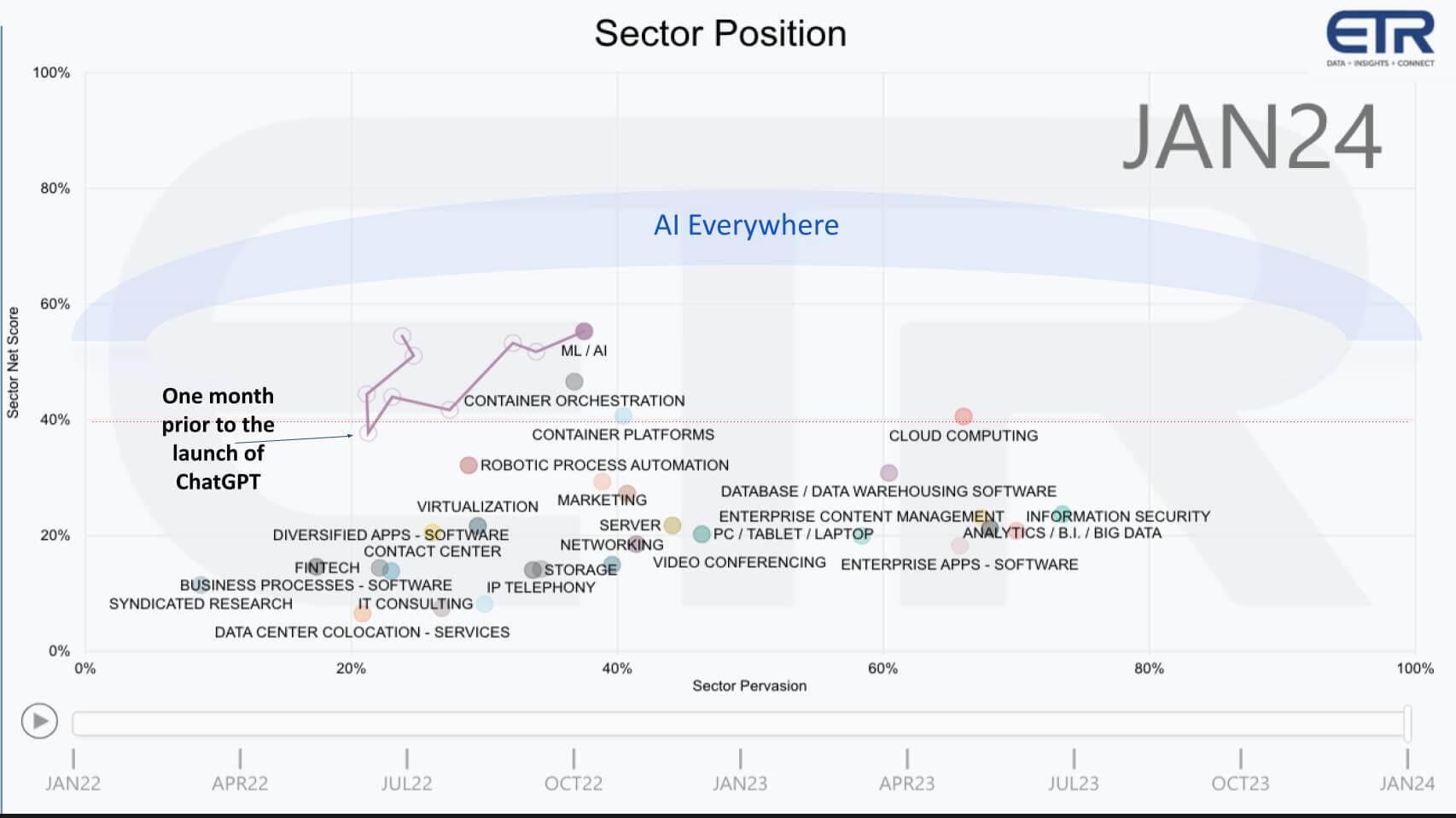

Under is a graphic from Enterprise Expertise Analysis that exhibits Web Rating or spending momentum inside a sector and on the X axis, the sector’s presence in a survey of greater than 1,700 enterprise info expertise choice makers. The vertical axis represents the online proportion of consumers within the survey spending extra within the sector and the crimson dotted line at 40% signifies extremely elevated spend velocity.

The primary level is that AI momentum was displaying indicators of deceleration after exiting COVID after which has taken over the No. 1 place on the vertical axis because the announcement of ChatGPT. The info exhibits that 44% of consumers say their generative AI initiatives are being funded by stealing from different budgets. So in watching this information over time many, if not a lot of the different sectors, have see contraction on the Y axis.

OpenAI and Microsoft by default have an enormous mindshare lead

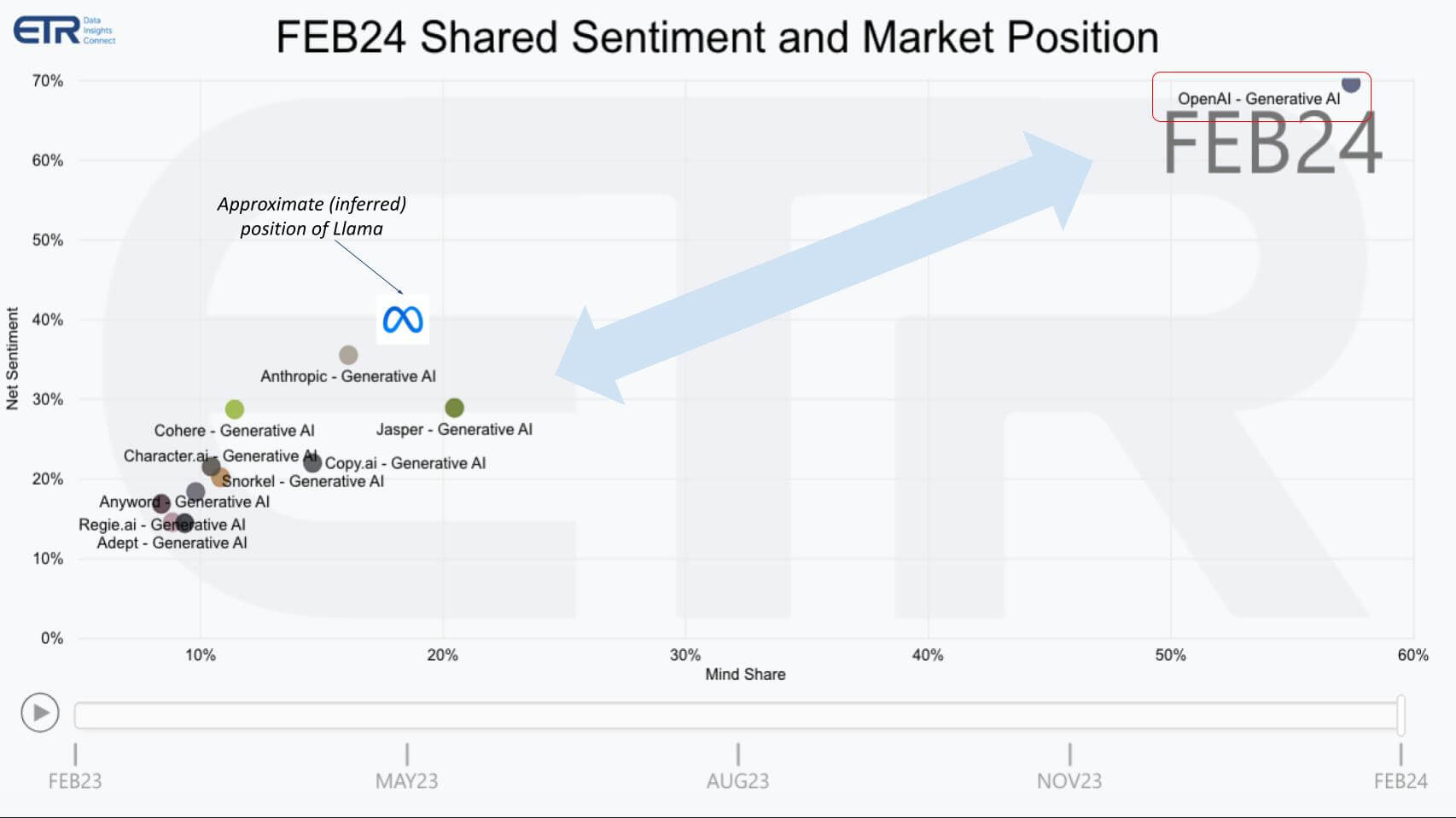

This subsequent graphic exhibits the massive language mannequin innovators, that are non-public corporations, and we’ve superimposed the place the info suggests Meta’s Llama would fall on the spectrum. This exhibits intent to have interaction or Web Sentiment on the vertical axis and Mindshare on the horizontal airplane.

And what you see within the higher proper – it’s thus far off the charts we needed to spotlight it – OpenAI is actually off the chart. And it has created a large hole between itself and the remainder of the LLM pack.

Q3. Ivana, you’ve this example the place enterprises are experimenting on AI and not using a large payback but. They’re stealing from different budgets to take action. Microsoft and OpenAI have taken the highest place in mindshare – they’ve unimaginable momentum and the remainder of the world is shifting quick to catch up. How are you enjoying this AI wave?

I believe your information is spot on with what we’re seeing in earnings getting reported proper now. There may be quite a lot of pleasure in AI however not quite a lot of it’s displaying up simply but within the numbers. And the rationale why is that, as you stated, mainly there’s spending on AI, however it’s getting offset by cuts in different areas. So the general spending that may come to a vendor could not look considerably greater than what it might’ve been with out AI and a secure or accelerating macro surroundings. However the vital factor to bear in mind for traders is that we’re nonetheless in a really powerful macro, proper? So should you’re seeing corporations nonetheless having the ability to develop 30%-plus, despite the fact that which may be a bit of decrease than what you’d’ve anticipated, these are nonetheless very strong numbers in mild of the present macro.

AI is displaying up a bit of bit. It’s mainly including few hundred foundation factors which might be possibly now getting offset by what’s been taken out by macro, however should you’re a long-term investor and might step again, you’re going to see as AI accelerates, you’re going to see it present up within the numbers. We’ve seen traders form of like going all in on the hype however then as soon as the numbers come by, not many affected person traders are there to stay round and see the advantages.

The AI contribution remains to be not sufficiently big to offset the macro headwinds.

A lot of Spear’s holdings present sturdy spending momentum

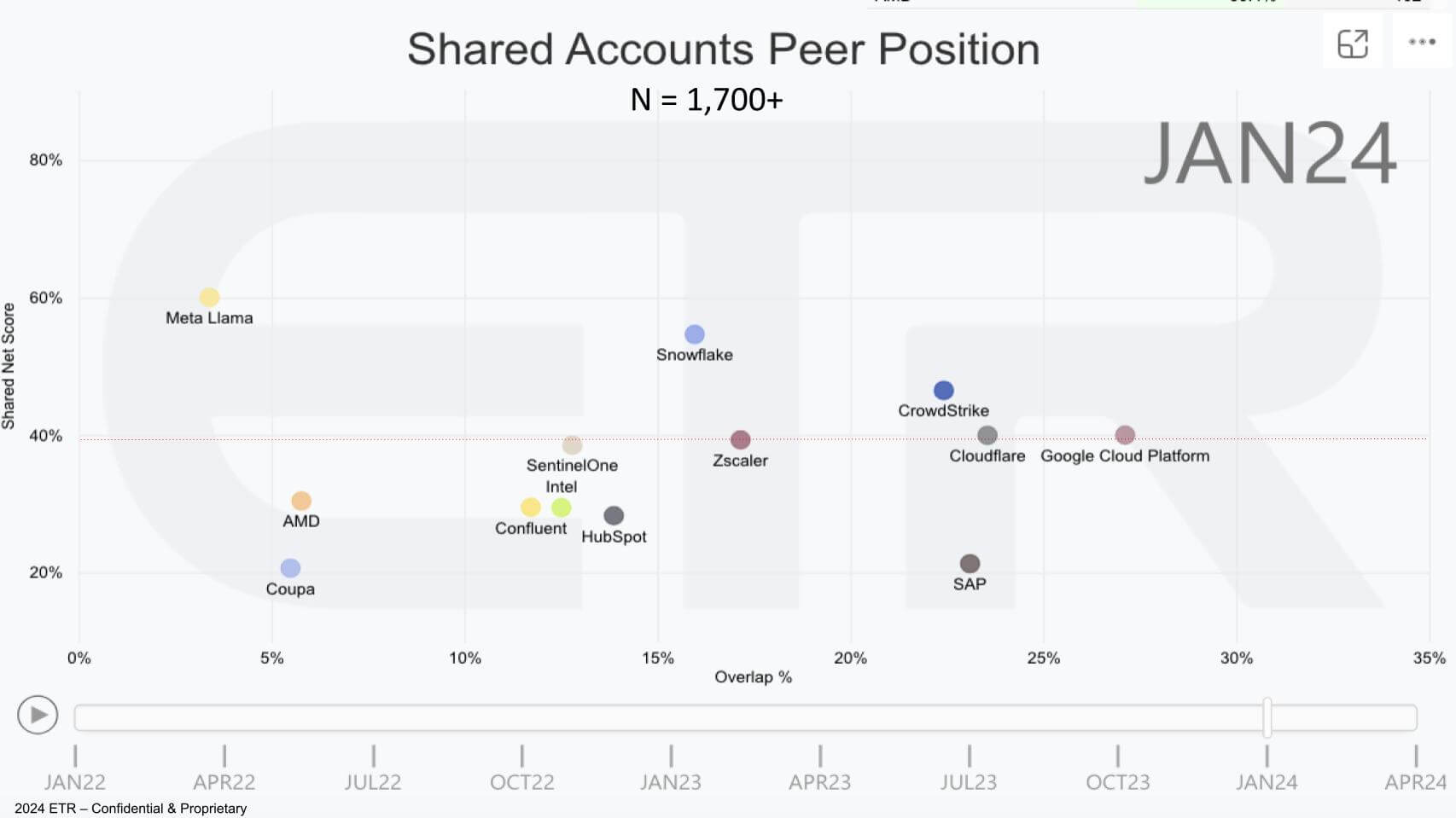

Let’s have a look at among the corporations that Spear owns or used to personal and see what the survey information says about them.

This chart from ETR, just like the one we confirmed earlier, plots Web Rating or spending momentum on the vertical axis and penetration into the info set on the X axis. And we’ve plotted most of the names Spear owns and a few they’ve trimmed reminiscent of Coupa Software program Inc.and Cloudflare Inc. And we’ve additionally put in another names like Meta’s Llama, Intel Corp. and SAP SE simply to stability out the chart. And we’ve purposely left off the hyperscalers as a result of they’re so dominant and skew the info.

First, most of the corporations Spear owns are close to or above the magic 40% mark – i.e., Spear owns companies with momentum from the client perspective. However let’s begin with the enterprise software program gamers.

Snowflake, Confluent, Hubspot, Shopify

This autumn. You’ve all the time been a fan of Snowflake. Frank Slootman stepping down as CEO spooked traders. What’s your place on Snowflake?

The unique announcement when Frank stepped down was a reasonably large shock to the market and that’s why you noticed the inventory being hit so exhausting. Nonetheless, should you step again and also you have a look at Snowflake’s execution, they’ve been very sluggish in arising with new merchandise to the market. So should you have a look at the numbers, we’d’ve anticipated the numbers to positively inflate — final quarter however for positive this quarter — and you actually didn’t see that. You actually didn’t see that present up in numbers and now they’re guiding to a bit of over 20% development, which isn’t actually all that nice for an organization with this sort of positioning out there, particularly with what’s occurring with with AI and all of the merchandise that they’ve been speaking about.

I simply attended a buyer occasion yesterday for Snowflake, which was very fascinating. The merchandise that they’ve been introducing to the market like Cortex, they talked about it yesterday they usually did a demo of how simple it’s to make use of. They’re truly super-interesting. We’re simply in this time period the place there’s not sufficient demand due to these cloud optimizations to offset what’s new coming from this new merchandise that they’re saying which haven’t reached essential scale. However we’re nonetheless very optimistic on the corporate as a result of as you look into second half, you’ll begin seeing contribution from these new product bulletins. So we’re truly, like after strolling out of that buyer occasion yesterday, I got here out fairly optimistic. It’ll take a while for it to work itself by and get traction with these use instances, however I nonetheless actually like Snowflake.

Q4a. OK, what about Confluent. It’s a wager on real-time streaming, constructed on high of open-source Kafka. The inventory has been form of up and down. What’s your angle there, Ivana?

The inventory actually fell out of favor two quarters in the past after they reported mainly two prospects left the platform after which folks began getting all frightened about that after which they stated, oh properly, one of many prospects is definitely shifting from the cloud again to on-premises, which was like, oh my God, like possibly that is taking place throughout the board. So digging into the small print, we didn’t discover the client loss that important. I believe the inventory was down over 40% that day. So it ended up being a really engaging entry level for us. And as we’ve realized extra in regards to the firm, information streaming could possibly be as large market as information at relaxation. So that is one thing that it’s a bit of bit extra underneath the radar than information at relaxation and a bit of bit much less understood.

However mainly this could possibly be a fairly important market. And what they’ve executed lately with this Flink acquisition is mainly in a position to do real-time information processing. So I believe quite a lot of the traders, even on the earnings name, they didn’t fairly perceive what this firm does and the way Flink will profit it. So I believe digging one layer deeper and understanding the dimensions of the chance can actually make a reasonably large differentiation right here within the inventory worth. I believe information streaming will likely be a major alternative. They mainly decrease the associated fee to prospects to do that [streaming]. It makes a ton of sense, particularly the time the place persons are ROIs and slicing down prices.

So I believe this firm will do fairly properly. Once more, just like Snowflake, they’ve had some execution hiccups, so that they might want to show out their enterprise mannequin and step up their development from at present the twenties to 30%. In order these corporations and mainly, it’s fascinating how Snowflake got here out, it was a one-off, Confluent got here out, it was a one-off, the place like development is slowing. However then should you look, you form of see a sample throughout the board the place I believe quite a lot of it’s underneath the hood pushed by harder macro, proper? So whenever you see the macro stabilize, I believe quite a lot of these corporations will have the ability to re-accelerate development.

Q4b. Now, you trimmed Coupa even earlier than they went non-public. Shopify and Hubspot are actually within the high 10 they usually’ve each executed fairly properly this 12 months. Why do you want these two?

We’ve owned Shopify and HubSpot for some time. Yeah, we’ve owned these two and Coupa mainly we exited a very long time in the past even previous to the deal as a part of a threat administration, like when issues have been promoting off. So I believe for HubSpot and Shopify, they’re going to be fairly important beneficiaries of AI as they personal only a ton of buyer information, proper? So we’re nonetheless on the early innings the place we don’t precisely know the way they’re going to have the ability to use this information and what they’re going to be doing with it. However they are going to mainly profit, they are going to have the ability to introduce instruments that they’ll promote to their prospects the place the shoppers can use the info and have the ability to give you predictive issues.

So like HubSpot, I’m at present a consumer of it as properly. And mainly what it could do sooner or later is that if AI can someway assist predict who’re the shoppers that you need to be calling on, proper? That may be a fairly important time saving for the customers. And equally Shopify simply sees a ton of commerce information, proper? So that they’re form of on the forefront of innovation so that they’re going to have the ability to use these to develop instruments that may leverage this information.

The cyber play: CrowdStrike, Zscaler, SentinelOne and trimming Cloudflare

Q4c. Let’s discuss cybersecurity and begin with CrowdStrike, looks as if folks can’t personal sufficient of that platform play. Zscaler is a little bit of a head-scratcher. They beat, increase and drop as a result of the 12 months is back-loaded and skewed towards bigger offers. And SentinelOne had sturdy earnings however a weaker-than-hoped information. S is sort of a less expensive model of CrowdStrike. Why do you prefer it these and whydid you trim your Cloudflare place?

Actually going into this 12 months I believe cybersecurity goes to be a fairly important theme and the truth that the shares have bought off so aggressively publish this incomes season is creating some very engaging entry factors. Mainly what’s been occurring is the businesses are popping out when it comes to earnings fairly near what they guided however they’re probably not beating by important quantities, and the Avenue, I don’t know if it’s as a result of expectations acquired a bit of bit forward of themself in December or is it the truth that rates of interest are creeping up and that’s a reasonably large headwind? However mainly after they report, there’s zero valuation help, so any small miss or remark actually will get [attention]. So I believe CrowdStrike clearly was most likely the strongest report out of the three, however the inventory is much more costly than SentinelOne.

I believed the SentinelOne report was very sturdy as properly. The corporate may have guided a bit of bit greater than what they did, however once more it’s a troublesome macro and a few of their new merchandise are nonetheless form of at some extent the place they haven’t reached scale but. They did say that at the moment cloud and information is about 30% of their bookings. In order that’s fairly important and that’s rising at 60%, 70%, 80% development price. So I believe all three look very engaging and yeah, Zscaler to your level, folks didn’t like that the information was actually implying a really sturdy fourth quarter however the firm was fairly assured on the decision, saying that they’re seeing bigger offers and they’re seeing improved momentum. So if I needed to say like out of the enterprise area, particularly publish this selloff right here after Q1, quite a lot of these corporations look very engaging.

After which CloudFlare, we nonetheless actually like it, I simply spoke to them this morning. I believe they’ve some very nice momentum on the zero-trust facet and and in addition on their employees and different platforms. It was extra a matter of valuation and the inventory is a bit of bit dearer than the remainder. However we’d look to enter, mainly any of those pullbacks I believe are very engaging entry factors for this area as a result of as quickly as you see rates of interest stabilize or the narrative change again to slicing charges, I believe you’re going to see these names hit new highs.

AMD and the broader semi commerce

Q4d. You personal AMD, which we present on the chart. We don’t actually have information on Nvidia, however how are you occupied with the semi commerce going ahead? How do you’re feeling about Nvidia’s moat? What are your issues?

Mainly for Nvidia, the priority could be as we attain additional into the cycle, you’re going to see the numbers nearer mirror actuality, which I believe we’re nonetheless just a few years away from now. What I might say although for Nvidia particularly is that you would be able to even personal the inventory by the subsequent cycle as a result of the info middle facet goes to be considerably much less risky than the normal gaming facet. As a result of information middle will not be bought by the channel, quite a lot of these GPUs are bought on to prospects. Once you see pullbacks or if there’s a digestion interval, you’re going to see a one-for-one affect. What’s been traditionally very cyclical for semis is whenever you see affect on demand, you virtually see a double whammy from the channel, proper?

As a result of persons are then going by a interval of de-stocking. So I believe what you’re going to see with Nvidia particularly, it’s much more sturdy and fewer cyclical cycles going ahead. So I believe we’re comfy proudly owning it within the subsequent two or three years due to the cycle however then ahead even by a cycle, proper? Perhaps not on the present measurement that we at present have it, however I believe you may comfortably maintain one thing like this by a cycle.

AMD is fascinating should you have a look at their numbers, they’re nearer to the underside than the highest, proper? So shopper is admittedly going by a down cycle and is simply stabilizing and embedded is one other phase that they’ve. These are chips which might be embedded into industrial merchandise. That really went by an upcycle and now it’s form of bottoming out. In order that’s why should you have a look at valuation, AMD will display a bit of dearer and the thought is that that’s as a result of the numbers are literally at a backside. So I believe despite the fact that it is probably not apparent simply by wanting on the inventory costs, I believe we’re actually nearer to the underside right here than the height within the semis.

Ultimate ideas: outlook for tech this Yr

OK, let’s wrap with some last ideas and get Ivana’s take in the marketplace going ahead.

Fed watching remains to be crucial for tech shares as a result of if you will get 5% parking cash that takes investments away from high-risk shares. However as we identified in our publish evaluating the AI wave to the dotcom, rates of interest again then have been 7% to eight% and tech shares have been booming.

The market has been attempting to go greater, and it has, because it has shrugged of hotter-than-expected inflation information, however earnings will proceed to be a serious driver – looks as if firm chief monetary officers are being conservative with steering as a result of macro, so possibly there’s some upside to earnings – though visibility stays a bit murky.

And the AI wager is that it’ll carry all boats and drive productiveness and financial development.

Q5. Ivana the market has been sizzling, it has run up very properly since your premise final summer season, so how do you play it from right here?

On the software program facet as we talked about, it’s a fairly important pullback. So I believe for traders that may take a barely longer-term — and and I’m not speaking a few 10-year view, I’m speaking about six- to 12-month view, simply to see this down cycle play out — I believe in software program, we’re discovering a ton of alternatives. As you stated, persons are simply overly centered on rates of interest, however rates of interest on their very own don’t actually have a destructive impact on the expertise sector. What you’re seeing is quite a lot of occasions when there’s volatility in charges, it creates this volatility within the inventory costs and never the basics, proper? So that they do find yourself being very engaging entry factors. I do suppose proper now, despite the fact that the cycle, despite the fact that the indices seem to be they’re at their peak, it’s truly a fairly engaging entry level for traders that may take a bit of bit longer view.

And to your level, I believe second-half comps are going to get very simple simply due to how powerful fourth quarter was final 12 months. Fourth quarter, as a reminder now — it looks as if it was in a distant previous — however charges hit 5%, issues got here virtually to a full cease from the economic system perspective and quite a lot of the earnings that you just’re seeing reported at the moment or over the previous few months actually mirror the fact that’s now a bit of dated. So I believe comps will get considerably simpler and the guides don’t appear very aggressive in any respect. I believe should you step again, it’s an excellent time to have a look at the tech sector.

Be in contact

Because of Alex Myerson and Ken Shifman on manufacturing, podcasts and media workflows for Breaking Evaluation. Particular due to Kristen Martin and Cheryl Knight, who assist us maintain our group knowledgeable and get the phrase out, and to Rob Hof, our EiC at SiliconANGLE.

Bear in mind we publish every week on theCUBE Analysis and SiliconANGLE. These episodes are all out there as podcasts wherever you pay attention.

Electronic mail david.vellante@siliconangle.com, DM @dvellante on Twitter and touch upon our LinkedIn posts.

Additionally, take a look at this ETR Tutorial we created, which explains the spending methodology in additional element. Word: ETR is a accomplice and separate firm from theCUBE Analysis and SiliconANGLE. If you need to quote or republish any of the corporate’s information, or inquire about its providers, please contact ETR at authorized@etr.ai or analysis@siliconangle.com.

Right here’s the total video evaluation:

All statements made concerning corporations or securities are strictly beliefs, factors of view and opinions held by SiliconANGLE Media, Enterprise Expertise Analysis, different friends on theCUBE and visitor writers. Such statements usually are not suggestions by these people to purchase, promote or maintain any safety. The content material offered doesn’t represent funding recommendation and shouldn’t be used as the idea for any funding choice. You and solely you’re chargeable for your funding choices.

Disclosure: Lots of the corporations cited in Breaking Evaluation are sponsors of theCUBE and/or shoppers of theCUBE Analysis. None of those companies or different corporations have any editorial management over or superior viewing of what’s printed in Breaking Evaluation.

Picture: MVProductions/Adobe Inventory

Your vote of help is vital to us and it helps us maintain the content material FREE.

One click on under helps our mission to offer free, deep, and related content material.

Be part of our group on YouTube

Be part of the group that features greater than 15,000 #CubeAlumni specialists, together with Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and plenty of extra luminaries and specialists.

THANK YOU

[ad_2]