[ad_1]

When entrepreneur Stephen Chen’s mother started approaching retirement age, she was compelled to borrow cash from Chen — and Chen’s brother — to make ends meet. They wished to assist, however the siblings additionally wished to determine a extra sustainable, long-term resolution that’d assist their mother retire with out having to fret about funds.

Chen tried to get steerage from a monetary adviser, however nobody would take his mom as a consumer as a result of her web value wasn’t thought of excessive sufficient. So Chen began constructing spreadsheets and monetary fashions himself, doing his greatest to determine how his mother may stay the retirement life-style that she wished.

“Individuals like my mother lack the instruments to have a look at their cash holistically and strategically to allow them to make knowledgeable choices, monitor their monetary state of affairs, perceive which levers to drag and when and make the connection between the alternatives they make at present and the long-term ramifications to their plan,” Chen instructed TechCrunch. “There’s a confluence of things which will alter the way forward for monetary planning and advising.”

It was after Chen helped his mother decrease her bills, determine when to say Social Safety, determine when to downsize and take different steps to change into financially unbiased that Chen realized a lot of different older People had been dealing with the identical challenges.

So Chen based NewRetirement, a Mill Valley-based firm constructing software program to assist individuals create monetary retirement plans. Right now, NewRetirement’s direct-to-consumer merchandise energy monetary planning for 70,000 customers managing near $100 billion in their very own monetary plans, in response to Chen.

“Our fashions transcend financial savings and investments, bearing in mind all the different elements in an individual’s life, from residence fairness, healthcare prices and taxes to Medicare and Social Safety,” Chen mentioned. “Each time a person makes a change, we run 1000’s of simulations to be able to assist them optimize their plan … We account for 1000’s of various situations, enabling customers to confidently map out accumulation and decumulation projections with digital steerage.”

NewRetirement is Chen’s second startup after Embark, a web-based school search and admissions instrument he launched in 1995. And, like Embark, Chen sees NewRetirement as a digital resolution to a transition confronted by tens of millions of People.

“120 million People over age 50 maintain 80% of the wealth on this nation,” Chen mentioned, “However operating out of cash stays a high 10 concern, with practically half of People saying they’re apprehensive about it.”

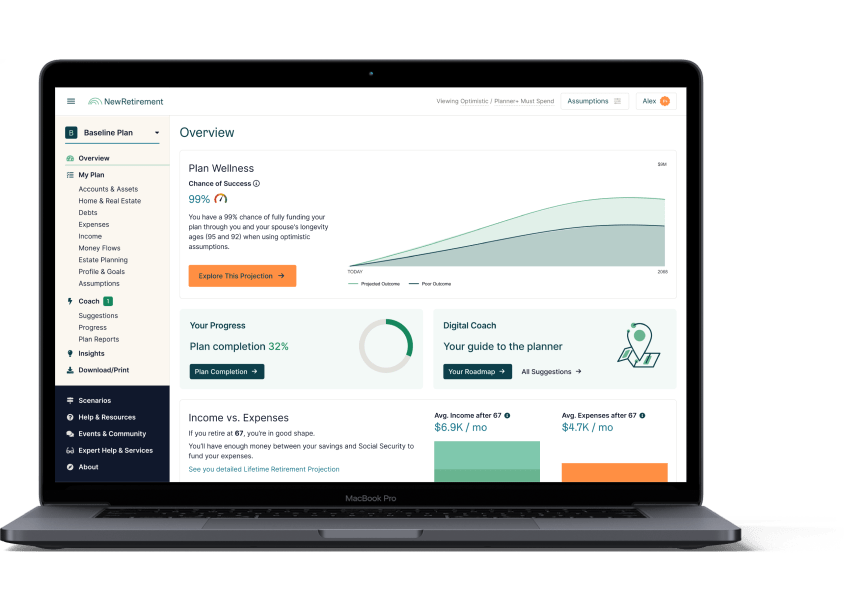

NewRetirement’s platform makes use of predictive modeling and knowledge analytics to assist customers suss out the fitting financial savings approaches. Picture Credit: NewRetirement

Certainly, the vast majority of People — as many as 65%, per Charles Schwab’s Fashionable Wealth Survey 2023 — haven’t any formal monetary plan. And whereas 37% of respondents say that they work with a monetary adviser, two-thirds of People imagine that their monetary planning wants enchancment, in response to Northwestern Mutual’s Planning and Progress Research 2023.

NewRetirement, which started as a shopper providing and in 2021 expanded to the enterprise, costs $120 per yr for entry to a set of instruments, calculators, suggestions and situation comparisons and ~$1,500 per yr for check-ins with an authorized monetary planner. As well as, NewRetirement sells a subscription-based non-public label model of its instruments aimed toward monetary advisers.

Now, you would possibly marvel, what makes NewRetirement completely different from startups like Retirable, which equally offers an array of retirement planning instruments and entry to asset managers? Chen asserts that NewRetirement is among the few — and maybe solely — monetary planning platform that serves customers in addition to advisers and workplaces.

“Our core innovation is permitting anybody to create a plan with industrial-strength instruments, enabling advisers to collaborate with the top person and making this accessible at scale by means of enterprise companions who deliver it to their clients,” Chen mentioned. “As extra monetary companies corporations see their choices like funding administration change into commoditized, there’s large worth in serving to shoppers and prospects take into consideration their cash holistically. By providing self-directed digital planning to shoppers versus beginning with a human adviser, they’ll scale and serve any variety of customers, find out about them, assist them make good choices and place their services extra successfully.”

Chen says that about 70% of NewRetirement’s income is enterprise presently, with the remaining 30% coming from shopper clients. The platform has 20,000 particular person subscribers and “a number of” wealth administration shoppers in addition to “a number of” enterprise clients together with Nationwide, which not too long ago expanded an current partnership with NewRetirement.

That momentum little question helped NewRetirement to cinch its Collection A funding spherical this month.

The corporate raised $20 million in a tranche that brings its whole raised to $20.8 million, led by Allegis Capital with participation from Nationwide Ventures, Northwestern Mutual Future Ventures, Plug and Play Ventures, Motley Idiot Ventures and others. Chen says that the money infusion can be used to broaden 50-employee NewRetirement’s enterprise merchandise, scale up onboarding, speed up R&D efforts and construct capability to satisfy future demand.

“With this new capital, we may have three to 4 years of runway,” Chen mentioned. “That provides us time to proceed to scale our enterprise partnerships and improve our product. What’s extra, the present downturn is enabling us to usher in unbelievable expertise. We’ve got a robust workforce in place and can broaden headcount additional this yr.”

[ad_2]