[ad_1]

We attended each Nvidia Corp.’s GTC convention and Broadcom Inc.’s investor day this week the place the factitious intelligence platform shift was on full show.

In our view, GTC24 was an important occasion within the historical past of the know-how trade, surpassing Steve Jobs’ iPod and iPhone launches. The occasion was not the most important however, in our opinion, it was essentially the most important when it comes to its attain, imaginative and prescient, ecosystem influence and broad-based recognition that the AI period will completely change the world.

In the meantime, Broadcom’s first investor day underscored each the significance of the AI period and the extremely differentiated methods and paths that Nvidia and Broadcom are every taking. We imagine Nvidia and Broadcom are presently the 2 best-positioned firms to capitalize on the AI wave and can every dominate their respective markets for the higher a part of a decade. However importantly, we see them every as enablers of a broader ecosystem that collectively will create extra worth than both of those companies will in and of themselves.

On this Breaking Evaluation, we’ll share our views on the state of AI and the way Nvidia and Broadcom are every main the best way with dramatically completely different however overlapping methods which may be headed for an eventual collision course.

Regardless of AI hype, the macro is softening

You’d by no means realize it from all of the AI froth however the macro seems to be getting worse.

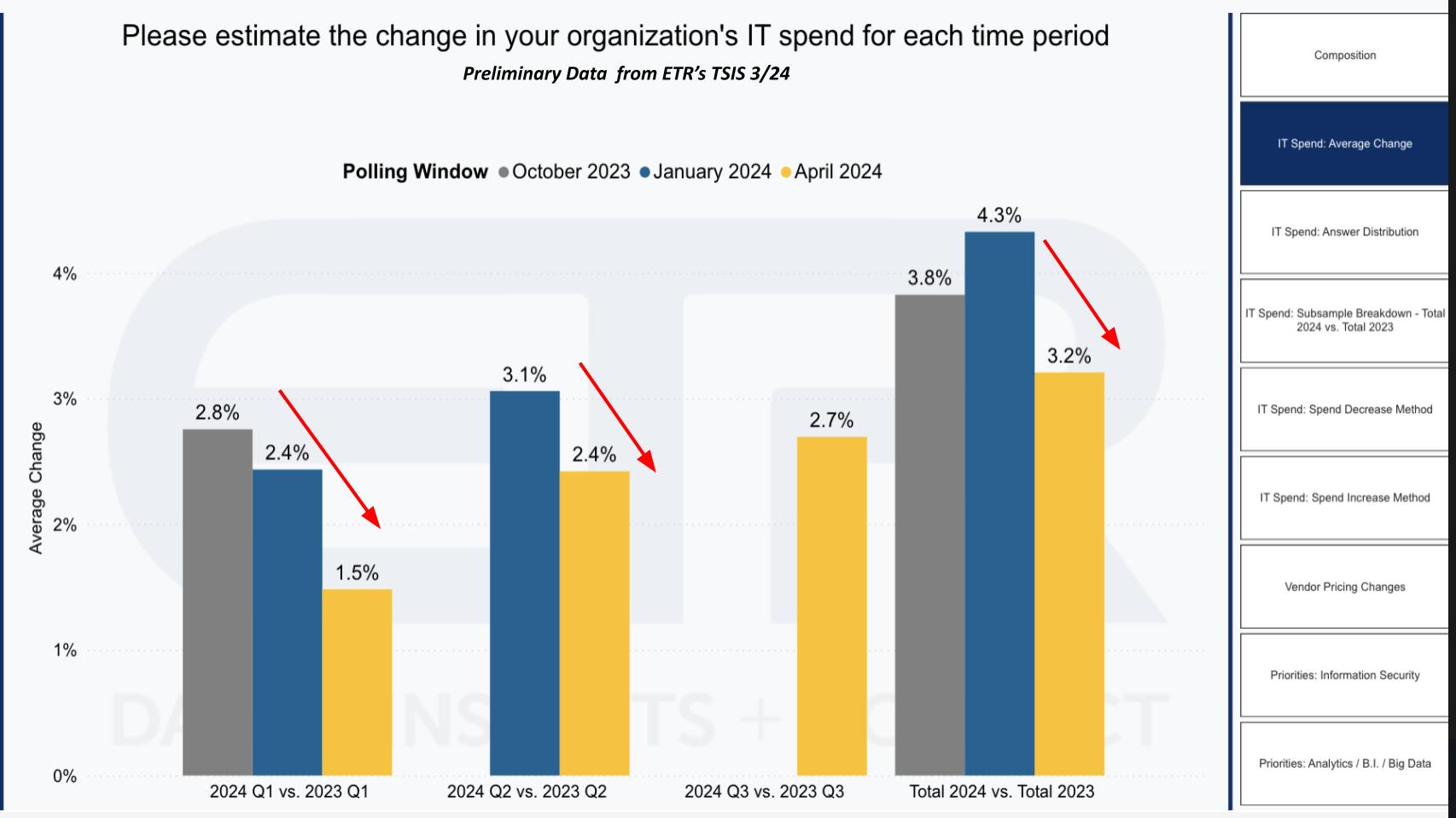

Enterprise Know-how Analysis shared the chart above earlier within the week with its non-public shoppers. It exhibits the anticipated data know-how spending development charges from greater than 1,500 IT resolution makers for 3 time intervals – October 2023, January 2024 and the latest survey within the discipline. Word the fabric drop in Q1 from 2.8% to 1.5% and greater than a 100-basis-point drop within the expectations for the full-year 2024. As we reported earlier this 12 months, the tech spending outlook is backloaded towards the second half and is additional deteriorating primarily based on the most recent information.

However the AI commerce is broadening

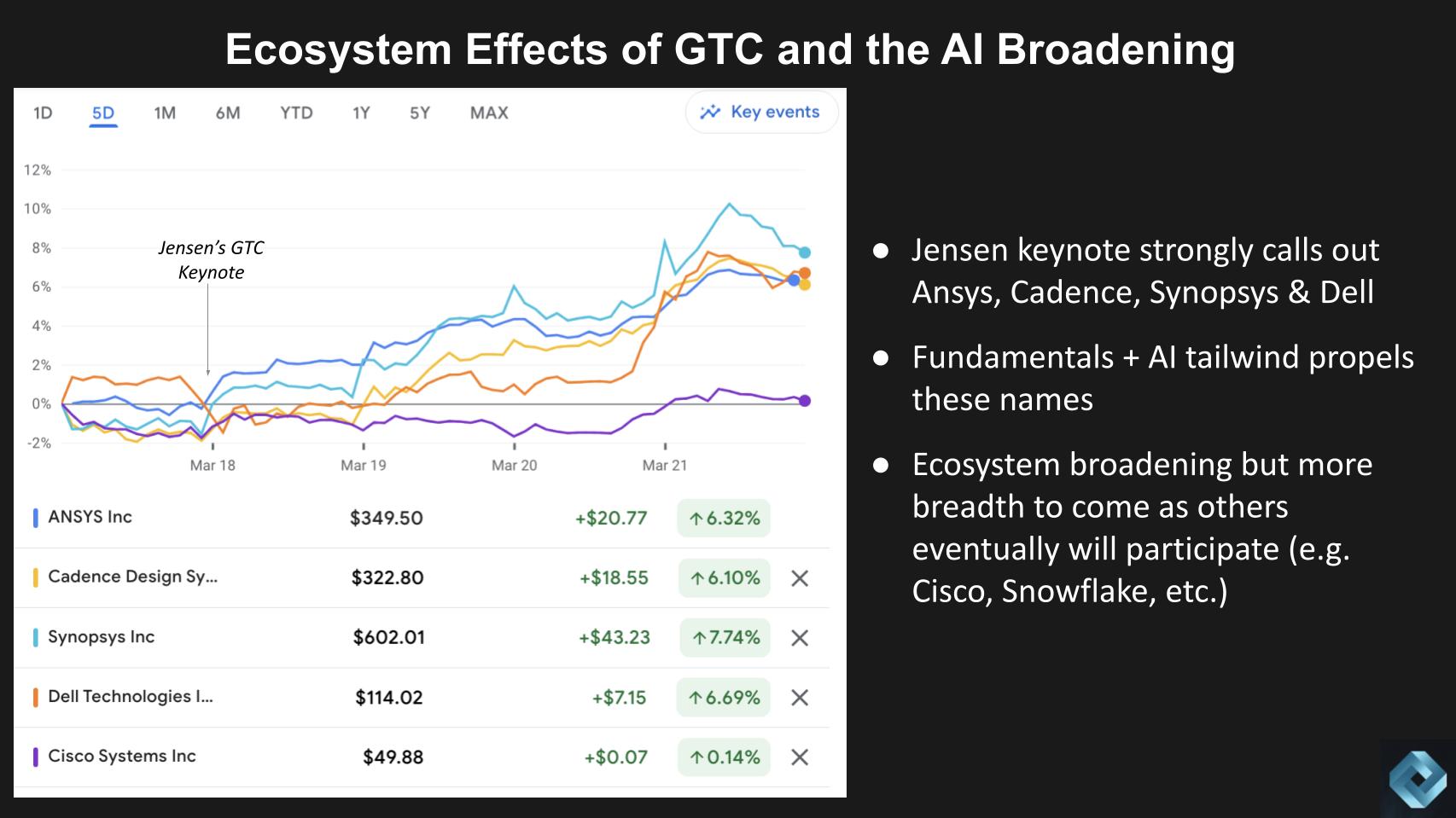

Regardless of the softer macro setting, we’re seeing countervailing results from traders towards clear AI beneficiaries past the giants. Particularly, the robust efficiency of the market in 2023 was slim with just some names powering the tech rally. Though each Nvidia and Broadcom have been a part of that momentum together with Microsoft and another names, 2024 is shaping as much as have a lot broader participation within the AI tailwind. Corporations comparable to Ansys, Cadence, Synopsys, Dell Applied sciences, Micron, IBM, Supermicro, Pure Storage, VAST Knowledge, ServiceNow, CrowdStrike Holdings, Arm, UiPath, Lam Analysis and plenty of others are benefitting from the froth round GTC24.

Above we present the latest motion submit Chief Govt Jensen Huang’s keynote at GTC24 for Ansys, Cadence, Synopsys and Dell, every of which obtained main shoutouts from Huang in his presentation. You may see all of them moved up properly and we imagine it’s from the mix of 1) the GTC momentum; and a pair of) good fundamentals, together with demand outstripping provide for these companies.

Within the case of Ansys, Cadence and Synopsys, they’re important design software program suppliers for silicon chips. Within the case of Dell, the corporate’s provide chain leverage is placing it in place to safe GPUs. Its execution is throwing of money that it’s returning to traders and as effectively it’s benefitting from the AI tailwind. And there’s seemingly extra to come back from a brand new PC cycle that can take form later this 12 months.

We additionally present Cisco Programs, an organization that isn’t thought-about an AI chief, although it has a sturdy portfolio, which incorporates many AI improvements. Cisco has silicon to energy AI networking, AI in its personal networking, AI in its collaboration software program, and information from its not too long ago accomplished Splunk acquisition and ThousandEyes to offer community intelligence information that may feed Splunk. However the macro is hurting Cisco proper now as the corporate has disenchanted traders not too long ago.

Snowflake (not proven above) is one other firm that in idea ought to be benefitting from AI as a result of it homes a lot important analytic information. It has partnerships with the likes of Nvidia and it has acquired AI experience within the type of Neeva. However traders have been shaken by Frank Slootman stepping down as CEO and the road is ready for Snowflake’s new chief, Sridhar Ramaswamy, to show that Snowflake continues to be on monitor.

AI is all over the place however nonetheless is within the experimental part inside the enterprise. Our premise is that whereas the macro continues to be difficult, AI will probably be infused into all sectors and ultimately be a rising tide for all areas of tech and past. Nevertheless, in the intervening time, although the return on funding of AI is obvious for client web firms comparable to Google and Meta Platforms, the enterprise influence for enterprise AI has not been as evident. Till it exhibits up within the quarterly numbers, we count on chief monetary officers to stay conservative with their price range allocations.

The purpose is that the AI rally is broadening however it’s nonetheless not a tide that lifts all ships. Nonetheless, a broadening of a rally indicators investor concern in regards to the valuations at main firms. They’re making the case for placing cash to work with different AI beneficiaries that would give them higher returns within the close to time period. As effectively, others such because the Cisco and Snowflake examples we shared will ultimately profit in our opinion. These are indicators in our view that there’s nonetheless loads of upside on this AI run. We perceive it’s only a matter of time earlier than the opposite AI winners change into extremely valued and the market will get toppy. However we’re not there but, in our view.

Nvidia GTC marks an trade milestone

GTC was a outstanding second for our trade. The occasion was held within the San Jose Conference Heart, a venue that was stuffed to the max in 2019, the final time GTC was held as an in-person occasion. GTC24 was far too massive for this venue. In actual fact, the keynote happened within the SAP Heart sports activities enviornment, a couple of mile from the primary occasion. Rumors circulated that Jensen wished GTC to be held on the Sphere in Las Vegas however it was booked. Maybe subsequent 12 months, as clearly GTC has outgrown the coziness of San Jose.

The principle venue was packed for days, with Monday seeing the most important attendance. Maybe as many as 30,000 individuals attended over the course of the week, however what made GTC so vital was the attain not solely within the know-how neighborhood however with many presenters exterior tech in automotive, healthcare, monetary companies – just about each trade was represented.

A brand new trade platform: The tokenization of every part

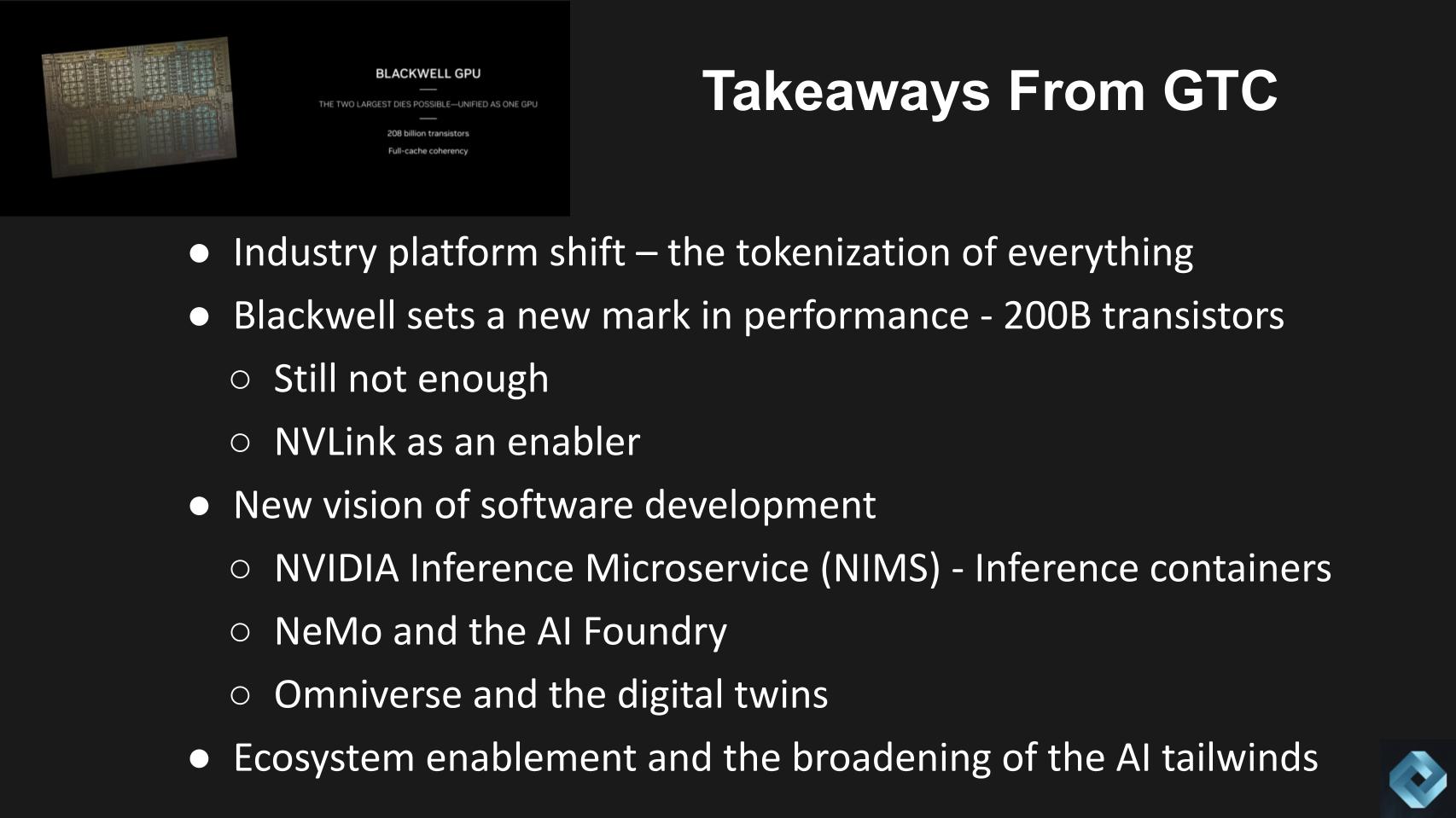

The large takeaways – and there are numerous we gained’t contact on immediately – began with Jensen’s keynote and his imaginative and prescient for the trade and what he calls accelerated computing. And the constructing of AI factories. The imaginative and prescient he put forth through the week was {that a} world of generated content material is right here. The pictures from his keynote he mentioned have been all simulation, not animation – and the simulations have been spectacular.

He additionally put forth a imaginative and prescient of a token financial system the place the pc sees tokens and these tokens might be generalized. Should you can generalize, he mentioned, then you’ll be able to speak to the AI and generate photographs, carry out gene evaluation, management robotic arms and extra.

The world’s greatest GPU

Jensen mentioned that Blackwell, its new chip named after mathematician David Blackwell, was constructed for this generative AI second. He described a reinforcement studying loop the place coaching, studying and era change into a part of the identical course of. And if performed effectively and sufficient instances, it turns into actuality. He implied that this workflow would carry out each inference and coaching and a important enabler to Blackwell is NVLink, a excessive pace interconnect that’s proprietary to Nvidia. He mentioned Blackwell took three years, 25,000 individuals and $10 billion to create, with unbelievable complexity – 600,000 components and plenty of software program to do switching, hyperlinks, cables and all of the plumbing.

He additionally defined that Nvidia is just not a chip firm. Somewhat, it builds total programs, then disaggregates them to promote to clients. This little doubt precipitated some stress amongst programs distributors.

A brand new software program improvement paradigm

GTC24 is a developer convention first, despite the fact that that time will get misplaced generally in all of the noise from the ecosystem. Jensen laid out a imaginative and prescient for builders displaying off NIMS (Nvidia Inference Microservices), that are inference containers. As effectively, there’s NeMo (Neural Modules), that are fashions for conversational AI and a platform for creating end-to-end generative AI utilizing automated speech recognition, pure language processing and retrieval augmented era at very excessive efficiency.

And he mentioned the AI Foundry, which packages all this know-how into programs and primarily adjustments the best way information facilities are constructed.

He additionally spent a whole lot of time displaying off Omniverse a platform of APIs, companies, and SDKs that enable builders to construct digital representations of a enterprise and its workflows utilizing generative AI-enabled instruments. Jensen talked about digital twins at size and had robots on stage with him.

In a personal assembly with Jensen, he informed us that inside eight to 10 years, robots will probably be typically absolutely functioning. And he mentioned this will probably be performed with “only a bunch of tokens.” Suppose tokenizing of motion. He mentioned we’ve a number of information and there’s a finite vocabulary round what varied human actions like strolling, sprinting, skipping, throwing, hugging and the like seem like. And this may be simulated with AI — and performed so very precisely by being tokenized and made generative.

A key, he mentioned, was to have the ability to floor Omniverse within the legal guidelines of physics and he described a cycle of imitate>be taught>adapt>generalize>reinforce and floor within the legal guidelines of physics.

Ecosystem enablement

The ecosystem was on full show at GTC24. Nearly each firm with a play in AI was basking within the AI glow. Therefore the broadening of the AI tailwind we’re seeing post-GTC.

You left the occasion really believing we noticed proof of a brand new period rising and coming into full swing. The times of Moore’s Regulation driving trade innovation are over. A brand new efficiency curve has emerged and new types of computing will dominate just about all sectors for the subsequent decade.

This was the robust feeling one will get when assessing the influence of GTC 2024.

In the meantime, Broadcom continues to execute on a differentiated AI technique

A unique however compelling AI imaginative and prescient was put forth by Broadcom at its investor occasion.

Broadcom held its first-ever investor day at its services in San Jose on Wednesday morning, completely timed to capitalize on the GTC24 momentum and place the corporate for traders. It was attended by each buy-side and sell-side analysts and only some trade analysts comparable to ourselves.

This was Charlie Kawwas’ present, designed to teach the funding neighborhood on Broadcom’s distinctive strategy to the market. We realized rather a lot from the president of Broadcom’s Semiconductor Options Group about its technique, philosophy, know-how, execution ethos, engineering expertise and we noticed demos of a number of the most forefront silicon know-how on the planet.

Broadcom has 26 divisions or P&Ls and 17 of them are within the semiconductor group. The semiconductor group is a roughly $30 billion income enterprise, rising within the double digits. The group spends $3 billion yearly on R&D.

Kawwas and his workforce took us by means of the historical past of how Broadcom got here to be, with roots in Bell Labs, HP, LSI Logic, LSI Avago, Broadcom, Brocade and extra not too long ago software program property comparable to CA, Symantec and naturally VMware.

Broadcom’s unconventional technique

Kawwas defined the corporate’s distinctive three-pronged technique proven beneath.

Broadcom doesn’t chase hockey stick markets to attempt to journey the steep a part of an S-surve. Somewhat, it appears for sturdy markets with sustainable franchises which have a decade or extra runway. In these markets, it goes for know-how management and it executes to a agency plan. With AI, Broadcom simply occurred to catch an enormous wave and is exceedingly well-positioned.

So this can be a good Powerpoint, however what was spectacular to us is that the 5 presenters coming after Kawwas every demonstrated: 1) a deep understanding of their markets and the historical past of their companies; 2) know-how management inside their division, displaying us once they entered the market, how they have been first with improvements, their know-how roadmaps and; 3) proof of execution.

The proof factors have been many from AI networks offered by Ram Velaga, server interconnects by Jas Tremblay, optical interconnects from Close to Margalit, foundational applied sciences comparable to SerDes which might be shared throughout the P&Ls from Vijay Janapaty, and customized AI accelerators offered by Frank Ostojic.

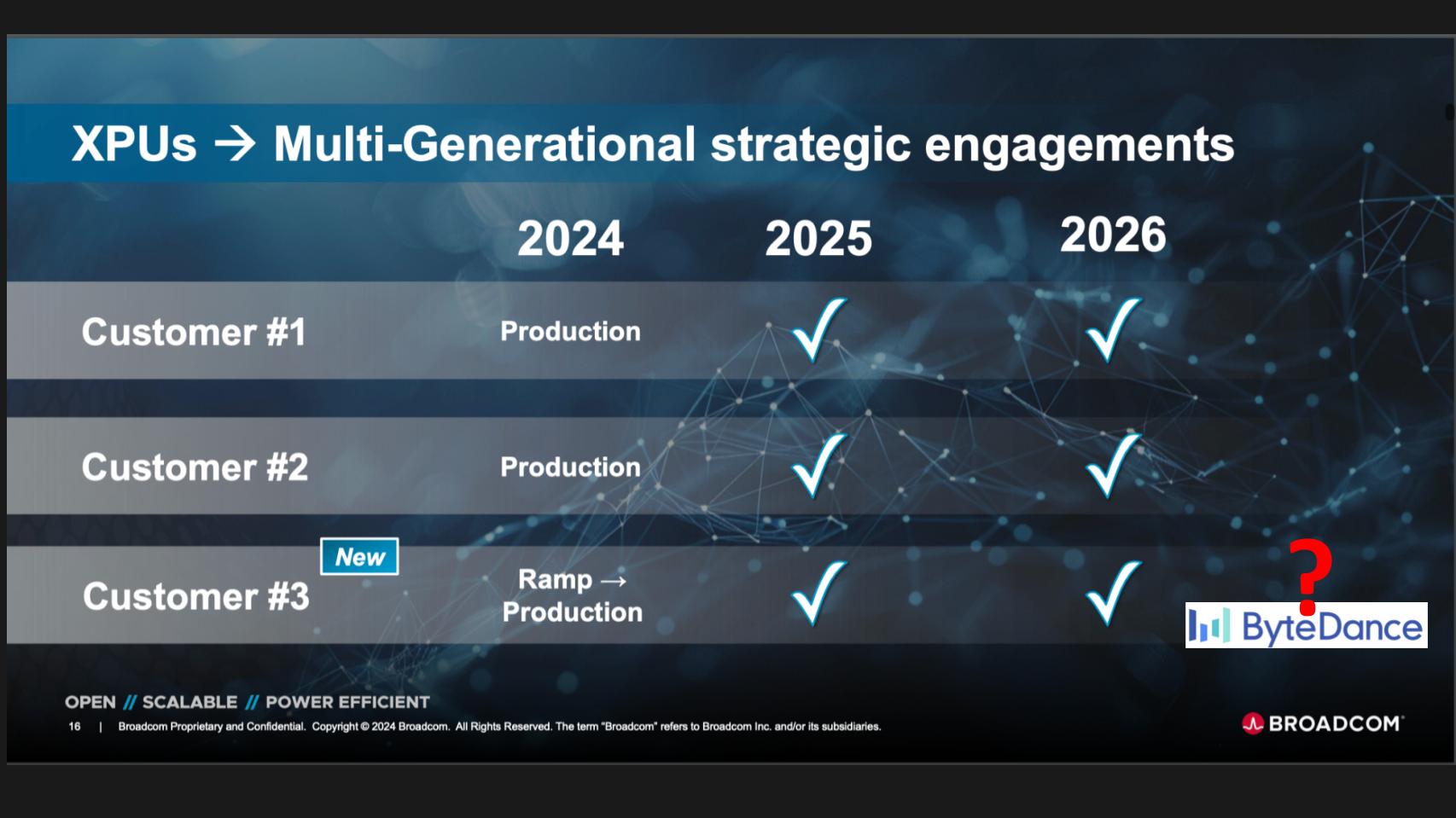

A brand new customized silicon buyer: Is No. 3 ByteDance?

The largest information from the occasion and a part of the explanation why the inventory popped after Investor Day — along with the credibility of the displays and the GTC24 momentum – was the announcement of a 3rd customized silicon buyer.

Buyer No. 1 is Google in our opinion. It has been a customized silicon buyer of Broadcom for 10 years. Customized buyer No. 2, we imagine, is Meta, a buyer for the previous 4 years and one the place Broadcom CEO Hock Tan sits on the board.

We have been all speculating on which buyer is No. 3. We expect it’s ByteDance, however this wasn’t disclosed. Kawwas was requested within the Q&A if its applied sciences are restricted from promoting to China and his reply was presently there are not any restrictions on promoting its know-how. So ByteDance, the proprietor of Tik Tok, can’t be dominated out.

However as effectively, we all know that ByteDance is a complicated buyer of Broadcom. It has a big community and has embraced Broadcom’s on-chip, neural-network inference engine, giving it programmability and adaptability. It is also a big consumer-oriented social community that may get quick ROI from utilizing extra customized versus service provider silicon.

Additional strengthening our perception that buyer No. 3 is ByteDance got here from a two different key takeaways from this dialogue that additional clarify the worth of customized silicon.

Client markets drive innovation forward of enterprise

- First, the enterprise case for client AI at firms comparable to Google and Meta are could be very robust. The larger the AI clusters they’ll construct, the higher AI they’ve, the higher they’ll serve content material to clients and the extra advert income they generate. ByteDance is a frontrunner in AI with maybe the most effective algorithm and it will make sense that customized silicon would additional help its mission.

- The second level is that the buyer web giants have very particular workloads, and for those who can customise silicon for these workloads, you’ll be able to considerably minimize prices and energy. Energy is the No. 1 downside at scale and these web giants are scaling up. So if customized silicon can save 80 watts per chip and these web firms use a whole lot of 1000’s or tens of millions of chips… effectively, you do the mathematics.

For these causes, we expect customized buyer No. 3 is ByteDance. Might or not it’s Amazon, Apple or Tesla? Perhaps… however we expect ByteDance makes essentially the most sense. And the explanation that is vital is as a result of these are sturdy clients with lengthy lifecycles and a extremely differentiated and really tough to displace enterprise.

These customized clients are AI-driven and can contribute to Broadcom’s AI income. The corporate elevated its AI contribution forecast saying that 35% of its semiconductor revenues will come from AI in 2024. That’s a ten% improve from earlier forecasts and its up from lower than 5% in 2021.

In 2024, 35% of Broadcom’s silicon income will come from AI workloads.

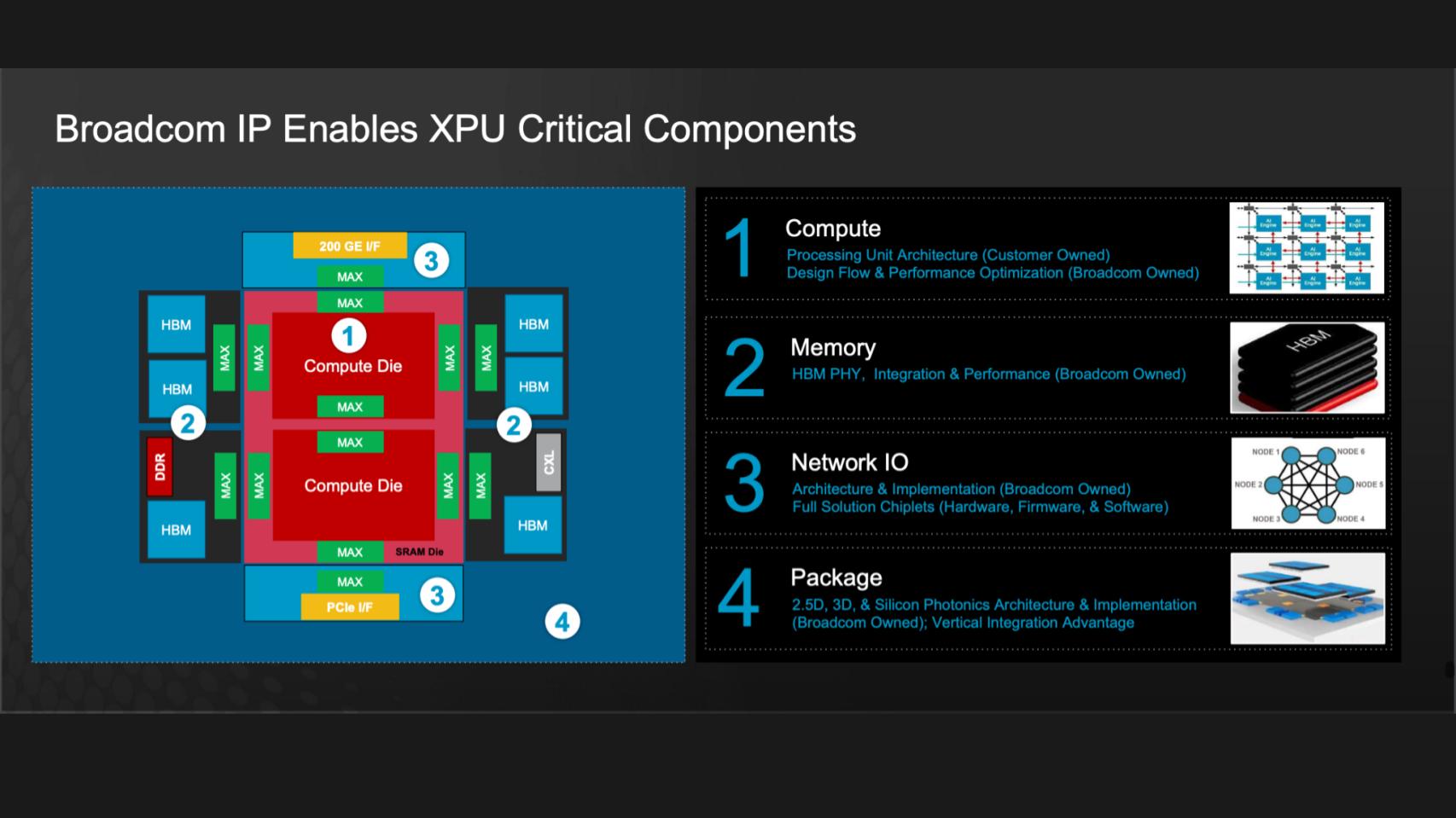

We don’t make GPUs….We make the stuff that makes XPUs and HBMs work

There’s a lot to unpack from the Broadcom assembly. We’ve virtually 90 slides of content material and a number of pages of notes from the occasion. However one different key level we need to go away you with is proven right here.

Broadcom’s premise is that we’re transferring from a world that’s CPU-centric to at least one that’s connectivity-centric. The emergence of other processors past the CPU such because the GPU, NPU, LPU – the XPUs, if you’ll – requires high-speed connections between them. And that’s Broadcom’s specialty.

And the facility of its enterprise mannequin is proven above. That is an instance of a kind of system wanted to help AI workloads. Broadcom applied sciences are proven on the appropriate and the numbers present the place they match within the packaging. The corporate is basically surrounding the AI infrastructure.

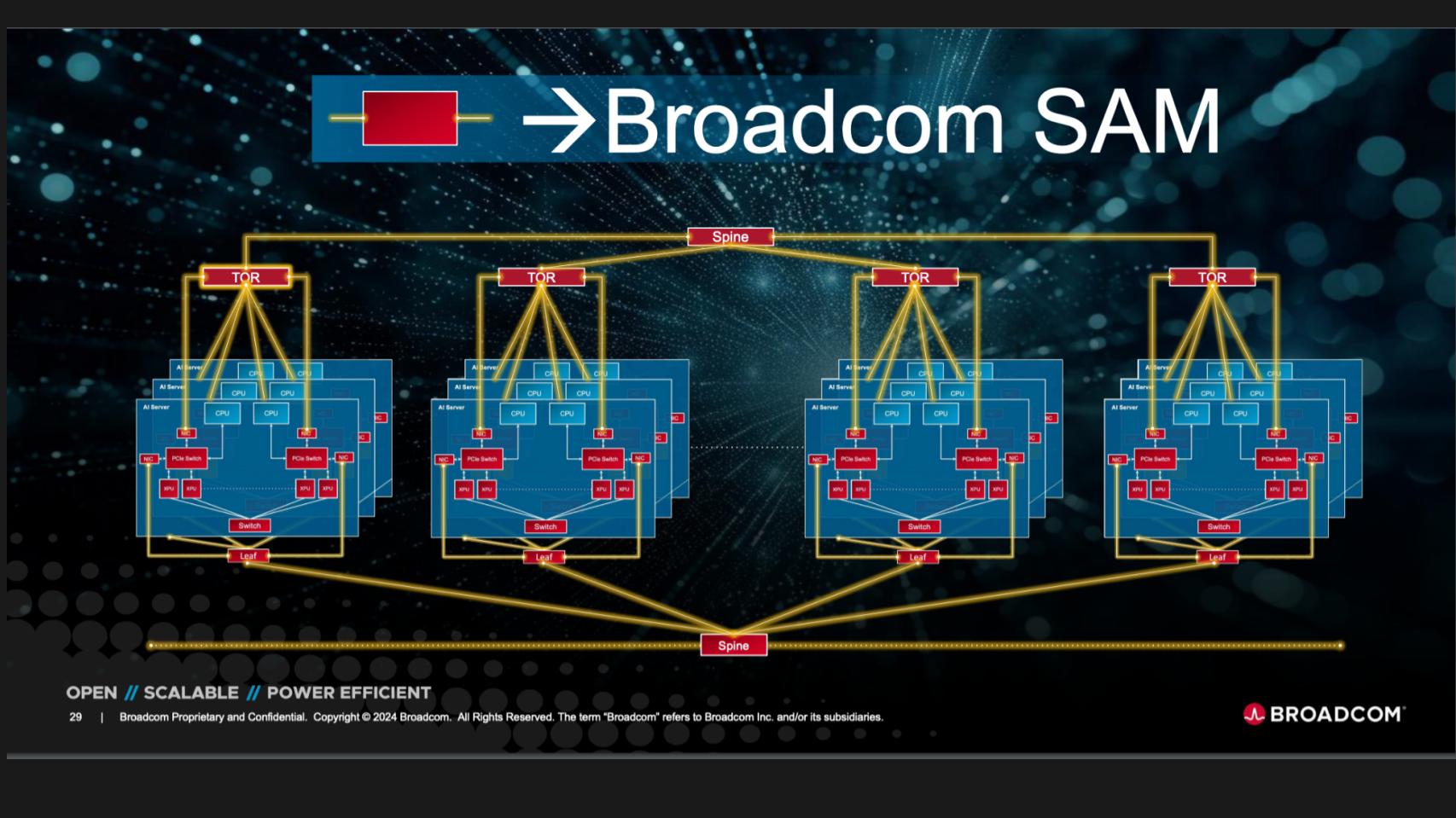

Think about Broadcom tech at scale

Under is a unique image of this dynamic with a configuration that scales up and out to many clusters. Broadcom’s know-how is proven within the purple and the yellow optics that join all the varied parts of a system, from the backbone, top-of-rack switching, NICs, PCIe innovation and the like. It has a large complete obtainable market past that GPU and CPU that could be a very tough market through which to take part.

One other key takeaway which was proven on all of Broadcom’s slides – Kawwas’ mantra – Open, Scalable, Energy-efficient.

Broadcom is targeted on open know-how requirements. Two examples are PCIe and Ethernet. There was a nuanced however fascinating tidbit shared by Jas Tremblay about Blackwell, Nvidia’s big GPU. The southbound connectivity of Blackwell is proprietary NVLink, however the northbound connection is PCIe. Nvidia’s extremely proprietary structure is constructed round Infiniband from the Mellanox acquisition. However even Nvidia should play within the open requirements world.

The southbound connectivity of Blackwell is proprietary NVLink however the northbound connection is PCIe. – Jas Tremblay, GM Knowledge Heart Options Group, Broadcom

Nvidia is Broadcom’s fastest-growing buyer

Regardless of the stress between Nvidia’s proprietary strategy to community connectivity and Broadcom’s embrace of Ethernet, Kawwas highlighted that Broadcom has an important relationship with Nvidia and Nvidia is its fastest-growing buyer.

So you’ll be able to start to see how compelling Broadcom’s enterprise mannequin is as a result of it sells to client web firms, gadget producers comparable to Apple, hyperscalers, enterprise gamers comparable to Dell and Hewlett Packard Enterprise and an important firm in AI proper now, Nvidia — which in some methods makes Broadcom as vital to the expansion of the trade.

One other clear takeaway is that Broadcom does the actually arduous silicon work that others can’t do. The instance given was many people can ski the inexperienced trails however the double blacks and excessive snowboarding with warning indicators and skeletons – Broadcom does rather well however that’s an enormous barrier to entry.

There’s a lot extra we might speak about and we’ll share extra over the approaching weeks and months as we digest this materials. Particularly within the Infiniband-versus-Ethernet dialogue, which was fascinating – Jensen saying Ethernet is basically ineffective for AI and Broadcom countering with many proof factors of AI leaders comparable to Meta, Google and others adopting Ethernet.

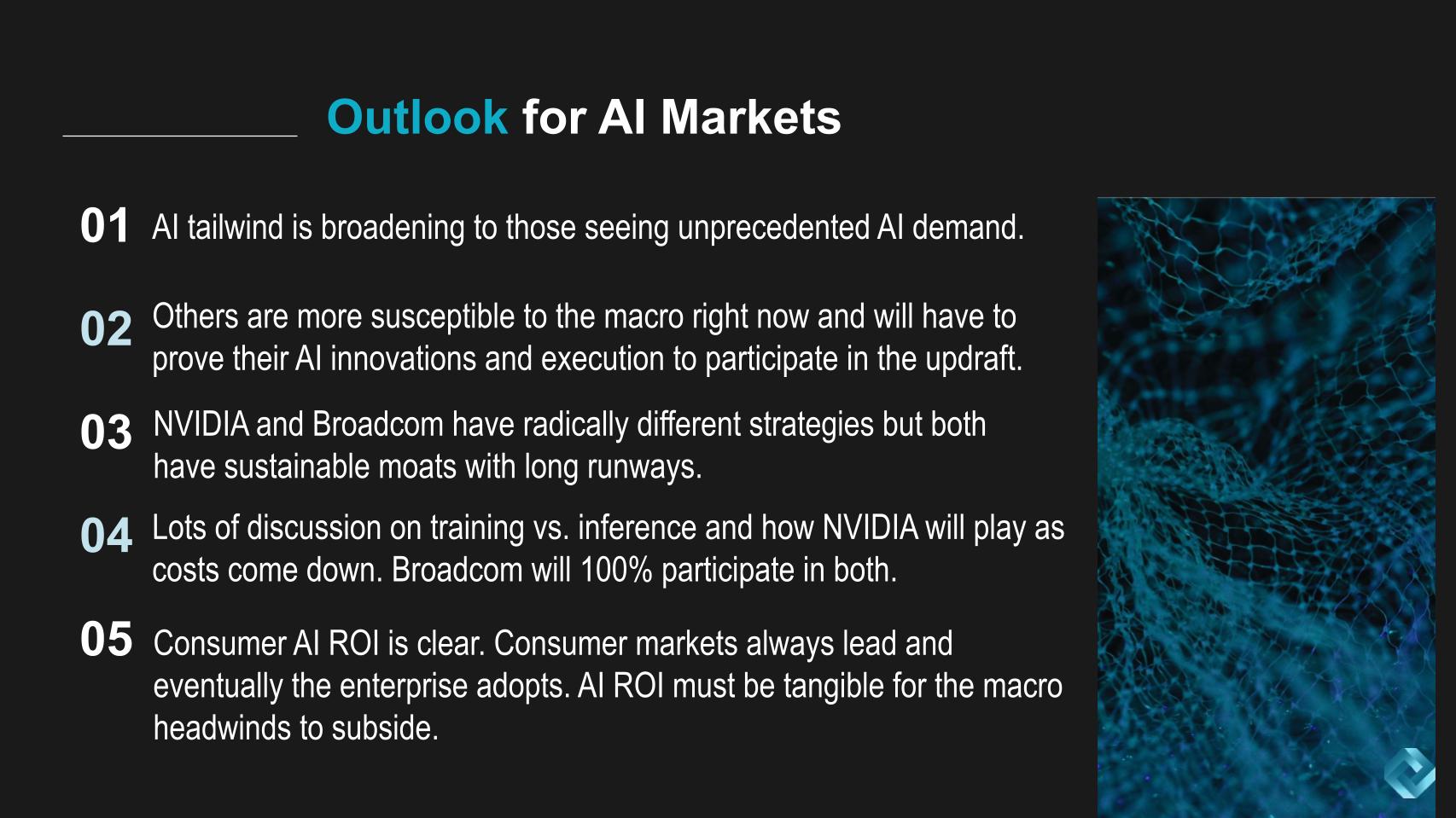

The AI outlook

We’ll shut with the next key factors:

- The AI tailwind is broadening and is particularly evident for these companies seeing unprecedented AI demand.

- Different companies are extra vulnerable to the macro proper now and must show their AI improvements and execution to take part within the updraft.

- Nvidia and Broadcom have radically completely different methods however each have sustainable moats with lengthy runways.

- There’s a number of dialogue on coaching vs. inference and the way Nvidia will play as prices come down. Broadcom will 100% take part in each.

- Client AI ROI is obvious. Client markets at all times lead and ultimately spill into the enterprise. AI ROI have to be tangible for the macro headwinds to subside.

Will 2024 be the 12 months of AI ROI within the enterprise, the best way it has been for years in client web markets comparable to search and social? We expect maybe within the second half of this 12 months, enterprises will begin to see ROI on their AI investments, however 80% of organizations are nonetheless firmly within the experimentation part. It’s extra seemingly AI ROI is a 2025 story the place sufficient worth is thrown off from investments to achieve share again into new AI tasks that can ideally drive productiveness development and fulfill the promise of AI.

For now, preserve experimenting, discovering these high-value makes use of circumstances and keep forward of the competitors in your trade.

Keep up a correspondence

Due to Alex Myerson and Ken Shifman on manufacturing, podcasts and media workflows for Breaking Evaluation. Particular because of Kristen Martin and Cheryl Knight, who assist us preserve our neighborhood knowledgeable and get the phrase out, and to Rob Hof, our editor in chief at SiliconANGLE.

Bear in mind we publish every week on theCUBE Analysis and SiliconANGLE. These episodes are all obtainable as podcasts wherever you pay attention.

E mail david.vellante@siliconangle.com, DM @dvellante on Twitter and touch upon our LinkedIn posts.

Additionally, try this ETR Tutorial we created, which explains the spending methodology in additional element. Word: ETR is a companion and separate firm from theCUBE Analysis and SiliconANGLE. If you need to quote or republish any of the corporate’s information, or inquire about its companies, please contact ETR at authorized@etr.ai or analysis@siliconangle.com.

Right here’s the total video evaluation:

All statements made relating to firms or securities are strictly beliefs, factors of view and opinions held by SiliconANGLE Media, Enterprise Know-how Analysis, different visitors on theCUBE and visitor writers. Such statements should not suggestions by these people to purchase, promote or maintain any safety. The content material offered doesn’t represent funding recommendation and shouldn’t be used as the idea for any funding resolution. You and solely you’re chargeable for your funding selections.

Disclosure: Lots of the firms cited in Breaking Evaluation are sponsors of theCUBE and/or shoppers of theCUBE Analysis. None of those companies or different firms have any editorial management over or superior viewing of what’s revealed in Breaking Evaluation.

Picture: DALL·E

Your vote of help is vital to us and it helps us preserve the content material FREE.

One click on beneath helps our mission to offer free, deep, and related content material.

Be part of our neighborhood on YouTube

Be part of the neighborhood that features greater than 15,000 #CubeAlumni specialists, together with Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and plenty of extra luminaries and specialists.

THANK YOU

[ad_2]