[ad_1]

Organizations proceed to spend extra on safety, with 87% of corporations anticipating to extend spend on cybersecurity within the subsequent 12 months. However are we safer?

It’s estimated that corporations on common have between 60 and 75 safety instruments put in. Though main distributors logically market the advantages of addressing instruments sprawl and complexity via consolidation, the information means that greater than half the corporations are growing the variety of safety distributors put in, with a really small share in a position to impact vendor consolidation.

Including to the problem is an surroundings the place safety operations execs have too many priorities to handle, together with id, vulnerability administration, patching, endpoint, safety and knowledge occasion administration, antivirus, zero belief, cloud safety and extra. Lastly, corporations are investing in synthetic intelligence to alleviate the crushing labor burden safety analysts are going through however are being compelled to stability innovation with the day by day battle.

On this Breaking Evaluation, we preview RSA Convention 2024 with our colleague Erik Bradley of Enterprise Know-how Analysis. We’ll present an in depth evaluation of a latest survey performed by ETR, completely timed forward of RSA.

Safety budgets are on the rise

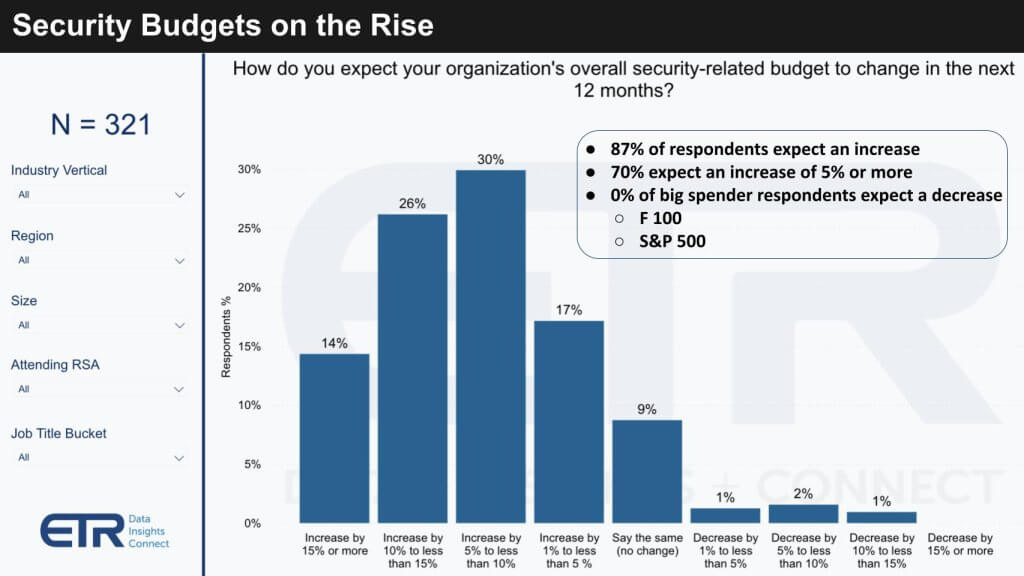

The chart under reveals knowledge from the latest ETR survey we referenced on the prime. As you possibly can see, the N is 321 respondents and the overwhelming majority, 87%, are growing spend on safety, with 70% anticipating a rise of 5% or extra, which is larger than the general data know-how spending common of three.4%. The opposite notable callout is that 0% of the Fortune 100 and S&P 500 respondents within the survey anticipate a lower in price range.

This knowledge represents a standout revelation from the survey in that 70% of consumers see their safety budgets rising by 5% or extra, a strikingly excessive charge of safety spending in contrast with IT spending at giant. The information additional reveals that greater than half of the surveyed corporations are growing their safety funding by 5% to 14%. Notably, an astonishing 14% of respondents are participating in what we classify as “hypergrowth” in spending, exceeding a 15% improve. This hypergrowth threshold isn’t strictly outlined and will embrace some very giant outliers, which leads us to imagine that the precise figures could also be considerably larger than reported.

Our evaluation additional identifies a notable development inside organizational dimension dynamics. Midsized corporations, which ETR categorizes as these with 200 to 1,200 staff, have 92% of respondents reporting spending will increase, and an distinctive 23% of them are anticipating hypergrowth. Conversely, the World 2000 corporations exhibit the least propensity towards hypergrowth, which is a rational development given their already substantial price range baselines. This disparity underscores that the speed of safety spend escalation isn’t solely surpassing basic IT expenditure but additionally varies by firm dimension.

Multicloud and ransomware are large drivers of spending will increase

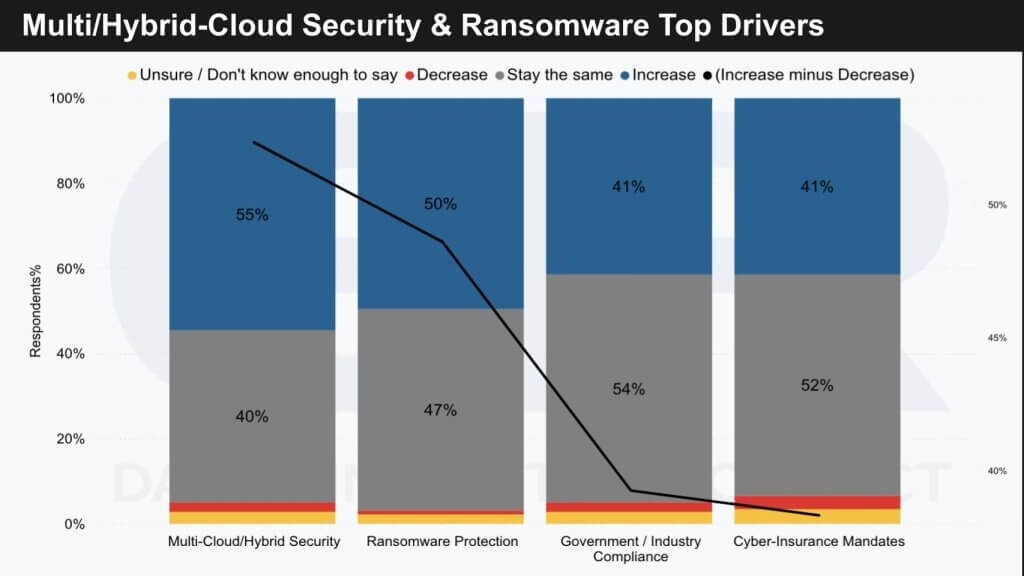

The information above reveals the areas driving the best improve in spend. Word the information is introduced on a double Y axis, in order that black line, which is the proportion of respondents growing spend minus the proportion lowering spend, is definitely fairly excessive on the righthand vertical axis.

Respondents within the ETR survey point out that multicloud and ransomware are pivotal elements influencing the rise in safety spending. We’ve famous in earlier Breaking Evaluation and supercloud analysis the complexity introduced on by the necessity to safe multicloud and hybrid cloud environments, which inherently broaden the risk floor. This complexity seems to be a considerable driver because of the rise in assault vectors it presents.

We be aware the next key catalysts for heightened safety expenditure are:

- Multicloud and hybrid cloud: As enterprises proceed to diversify their cloud infrastructure, safety spending follows swimsuit to mitigate the dangers related to these extra advanced environments.

- Ransomware safety: With ransomware constantly posing a big risk, it stays a prime precedence for organizations, probably explaining the surge in safety budgets.

We additional emphasize:

- Hybrid cloud’s momentum: In line with our earlier discussions, hybrid cloud is recognized as a present driving pressure. Whereas public cloud progress confirmed a interval of of deceleration, AI seems to be a brand new tailwind which can additional exacerbate the adoption and want to stay vigilant when connecting to on-prem property.

- Safety ramifications: There are implications for safety fashions and spending because of the hybrid/multicloud development. Particularly, as generative AI adoption grows, privateness, compliance, knowledge safety and different authorized considerations will escalate.

Apparently, cyber insurance coverage is seen as much less of a driver for elevated safety spending, significantly throughout the World 2000:

- We’ve seen a decline from 41% in earlier surveys to 25% in recognizing it as an elevated spending driver, suggesting a maturation development throughout the cyber insurance coverage market.

This perceived maturation maybe is the results of a rationalization throughout the business after years of tumult, reflecting a greater alignment between cyber insurance coverage calls for and the realities of safety software efficacy.

Consolidate to simplify, proper? Not so quick…

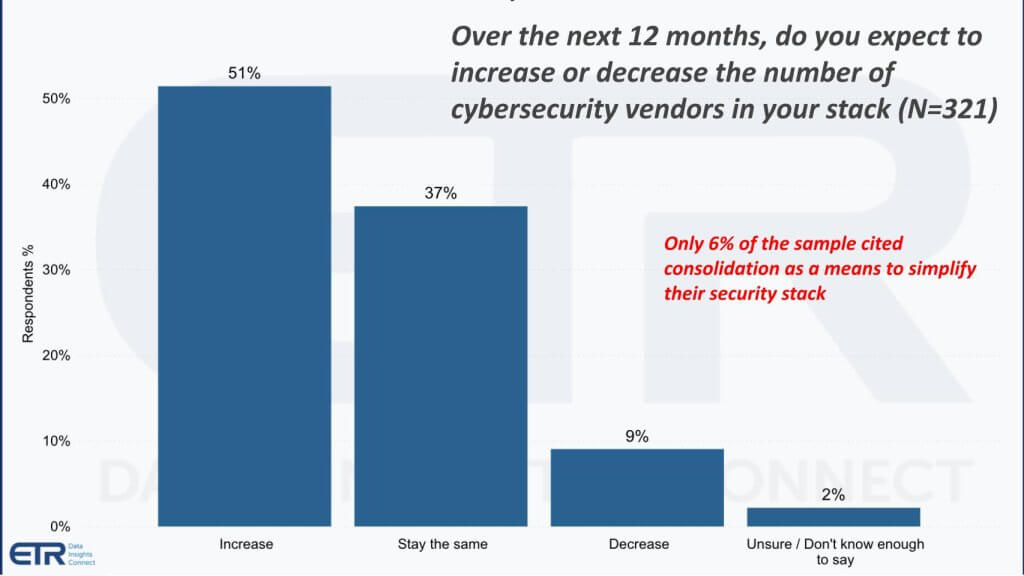

This subsequent set of information is eye-opening. The survey requested respondents whether or not over the following 12 months they anticipate the variety of safety distributors to extend, lower or keep flat. The prevailing narrative within the business would recommend that the majority prospects are consolidating the variety of distributors of their safety stack. They’re not.

Our analysis reveals a big deviation from the seller narrative relating to safety software consolidation inside organizations. Opposite to the profitable examples by main safety corporations corresponding to CrowdStrike Holdings Inc., Palo Alto Networks Inc. and Zscaler Inc., the information doesn’t primarily replicate a development towards vendor consolidation. Key findings embrace:

- A whopping 51% of respondents anticipate to extend the variety of distributors of their safety stack over the following 12 months.

- A mere 9% of organizations report a lower within the variety of safety software suppliers, with solely 6% attaining this via consolidation efforts.

These insights lead us to anticipate:

- Elevated complexity: The information suggests a trajectory towards higher complexity in instruments sprawl fairly than simplification.

- Widening expertise gaps: Extra distributors means extra tooling and higher complexity, additional pressuring organizational expertise.

- Higher demand for AI: This elevated complexity and lack of expertise will necessitate higher adoption of AI instruments to fill gaps.

This knowledge represents a contrarian view to the business’s consolidation rhetoric. Regardless of public earnings calls touting strategic shifts towards platform integration, the bottom actuality displays a persistent inclination towards “better of breed” options and a readiness to onboard extra distributors if deemed crucial.

The hole between strategic aspirations of safety corporations and the operational practices of end-users means that, though consolidation is a said objective, the business might not but be ripe for such a transition. The information firmly factors to a continued improve within the variety of safety distributors, emphasizing the necessity for vigilance as safety architectures evolve.

What IT practitioners see on the fround

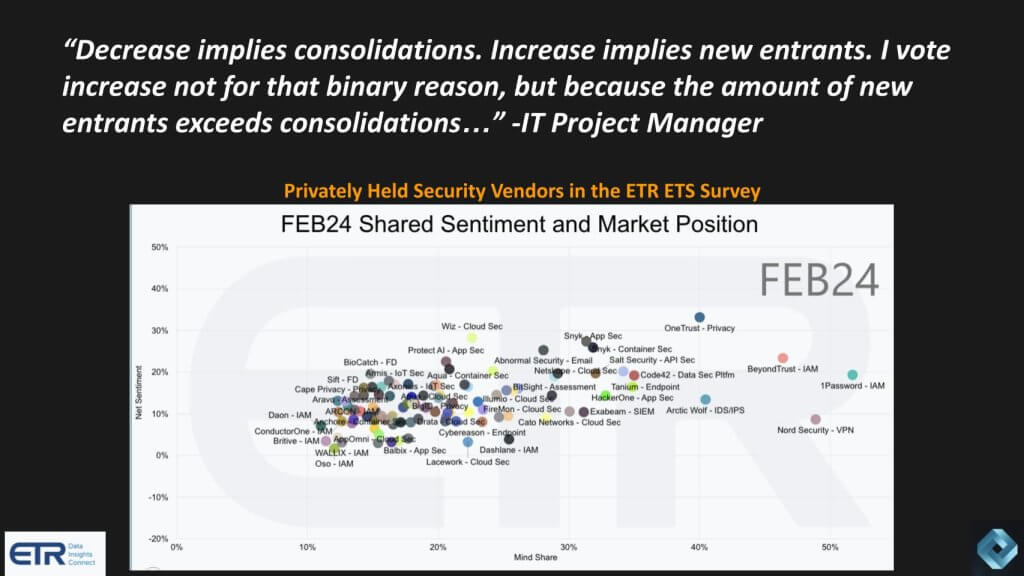

We posted a casual X ballot to evaluate sentiment in the neighborhood. Whereas half the respondents anticipated the variety of distributors to lower, a wholesome 30% indicated they thought the quantity would develop. We suspect these have been possible practitioners on the bottom. Under we present the remark made by one IT one who mentioned: “Lower implies consolidations. Enhance implies new entrants. I vote improve not for that binary cause, however as a result of the quantity of recent entrants exceeds consolidations.”

And for impact, we’ve superimposed an impossible-to-read chart – that’s the purpose – from ETR’s Rising Know-how Survey of privately held corporations. That is the safety sector and you’ll see how crowded it’s with names which might be well-known, corresponding to OneTrust, BeyondTrust, 1Password, Nord, Wiz, Snyk, Cato and a number of dozens of others.

The prevailing sentiment that vendor consolidation is the dominant development in safety isn’t substantiated by this knowledge. Reasonably, the alternative seems to be true and the information signifies an inclination towards the adoption of recent entrants available in the market fairly than consolidation. That is attributed to the sheer quantity of novel options surpassing the speed of vendor consolidation.

We be aware the next extra factors:

- A plethora of early-stage corporations: Quite a few startups are hyper-focused on specialised safety niches, revealing gaps that bigger, established gamers may not adequately deal with.

- Potential for consolidation and failure: The abundance of gamers within the safety sector signifies ripe situations for business consolidation or, conversely, market exits.

The sector’s dynamism and corporations’ vulnerabilities help the addition of recent corporations. This underscores the business’s speedy evolution and the important want for companies to stay vigilant and adaptable of their safety postures.

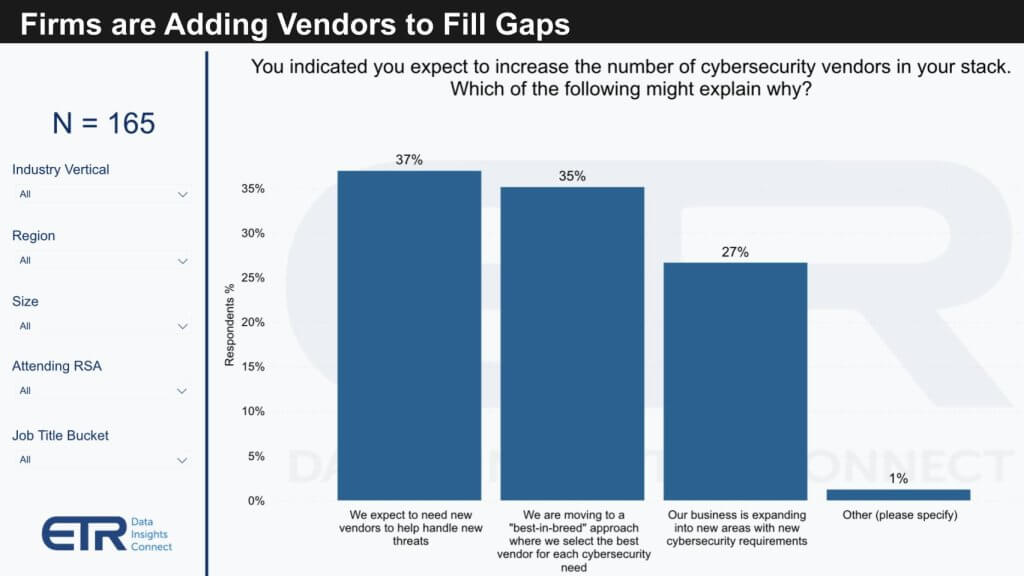

Digging into why corporations are including distributors

The information under drills into these respondents saying they have been growing the variety of distributors of their cyber stack. The survey asks them why they’re including distributors.

The implications are:

- Vendor gaps: There’s an implicit acknowledgment that current distributors fail to fill important gaps, significantly in specialised sectors. This not solely suggests a deficiency in present choices but additionally indicators the possible endurance of software sprawl as a big business problem.

- Specialization over consolidation: Regardless of the complexities, prospects discover worth in specialised instruments that cater to particular wants, reflecting a choice for high quality and specialization over the simplicity of consolidation.

- Market alternative: This hole in complete options by main distributors paves the way in which for brand spanking new entrants to innovate and seize market share.

There’s a notable consensus that although there’s a common choice for lowering the variety of distributors, this doesn’t overshadow the demand for sturdy safety measures. About 36% of the respondents highlighted the emergence of recent threats and the pursuit of best-of-breed options as major causes for elevated vendor counts. Moreover, 27% cited increasing enterprise initiatives as a contributing issue.

In stark distinction to this development, a small fraction of respondents — solely 29 out of over 300 — indicated a lower of their safety vendor stack, primarily motivated by price range constraints and a strategic push towards simplification.

We imagine the discourse round vendor worth and consolidation takes on higher significance in mild of the time period “spending fatigue” utilized in latest earnings calls. This has sparked debate amongst business leaders, with corporations corresponding to CrowdStrike and Zscaler reporting contrasting traits.

The query stays whether or not a single vendor can actually supply a best-of-breed expertise throughout a broad portfolio, a query highlighted in discussions with different analysts on theCUBE. The rising view appears to recommend that although “ok” would possibly work in sure areas, within the area of safety, the stakes are too excessive to accept something lower than best-of-breed, underscoring the enduring significance of a layered protection technique.

That mentioned, the expansion and growing ubiquity of Microsoft’s safety tooling, regardless of the scathing report by the federal government’s Cyber Security Overview Board about Microsoft’s poor safety practices, signifies that ok could also be ok for a lot of prospects. Nonetheless, we imagine greatest follow requires layering additional protections on prime of Microsoft tooling.

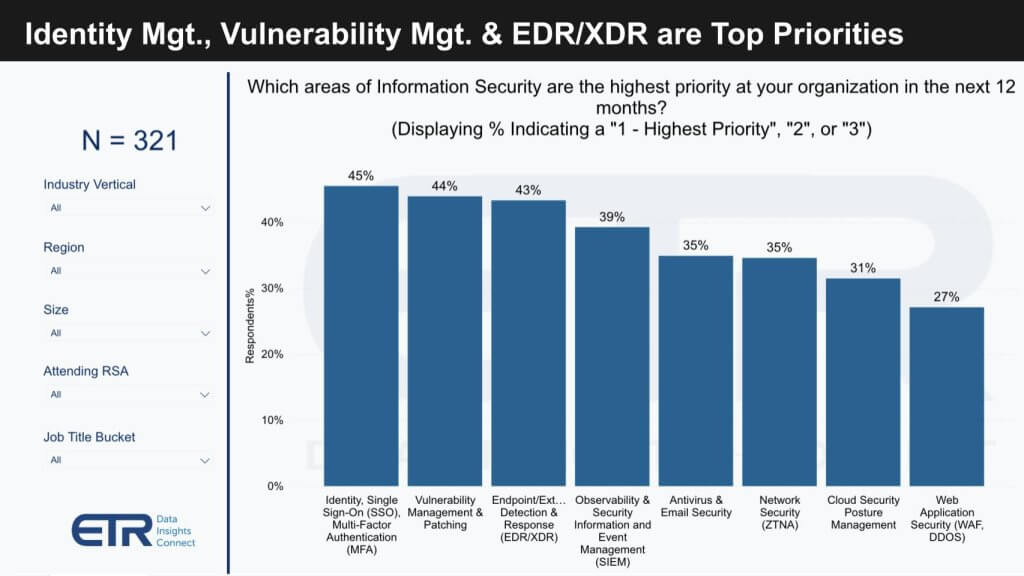

‘If in case you have 10 priorities, you could have none’

Within the phrases of former Snowflake Chief Govt Frank Slootman, “If in case you have 10 priorities, you could have none.” This chart under underscores the issue in cyber. You possibly can’t slender issues down to at least one precedence. Identification, single sign-on, multifactor authentication, patching, EDR, XDR, SIEM, observability, antivirus, zero belief, cloud, net software firewall – prospects face a by no means ending set of priorities. And in case you ignore any of them, you achieve this at your personal peril.

Our analysis reveals that within the area of cybersecurity, the disparity in priorities between C-suite executives and operational practitioners is turning into more and more evident.

ETR has launched a brand new product, Market Arrays, which gives a deep dive into the varied elements of id and endpoint platforms (with extra sectors coming) revealing that:

- Vulnerability administration: On the C-suite stage, vulnerability administration emerges as a paramount concern.

- Observability and detection: Operational practitioners prioritize observability, indicating a shift in focus towards visibility throughout the safety infrastructure. In the meantime, EDR and XDR have descended to decrease ranks when it comes to precedence.

This knowledge underscores the various focus areas inside a company, reflecting differing priorities primarily based on function and duty. It’s clear that although all sides of safety are deemed important, there’s a pronounced distinction between the strategic oversight of executives and the speedy, hands-on challenges confronted by analysts. Such disparities recommend a necessity for higher alignment and understanding throughout the completely different organizational tiers to successfully deal with the excellent safety panorama.

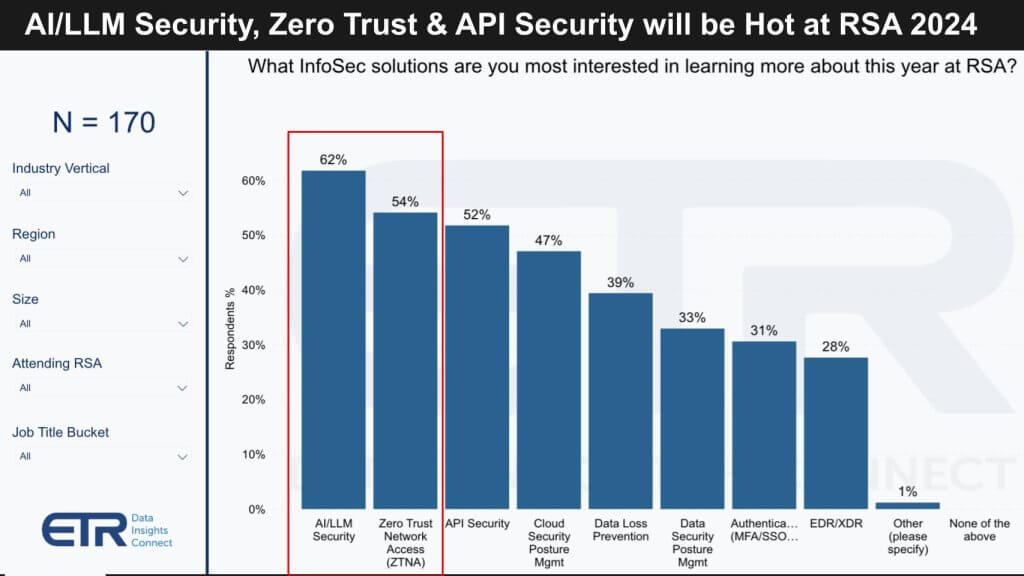

What do SecOps execs wish to see at RSA 2024?

Within the newest survey of 321 safety professionals, 170 (53%) have indicated their intention to attend RSA. Their pursuits span a spread of subjects, reflecting the present safety panorama’s complexity and the ever-growing calls for on safety operations professionals. The important thing areas of curiosity for RSA attendees are:

- AI in safety: A give attention to the mixing and implications of synthetic intelligence in safety practices.

- Zero-trust structure: Persevering with the momentum of latest years, zero-trust rules stay a important space of studying.

- API safety: With its excessive rating, this displays an acute consciousness of software programming interface vulnerabilities as important factors throughout the safety perimeter.

- Cloud posture administration: As cloud environments turn into extra advanced, managing their safety posture is of paramount significance.

- Knowledge loss prevention: Regardless of its decrease rating, DLP stays a staple concern inside data-centric safety methods.

- Knowledge safety and authentication: These basic elements proceed to be a priority, particularly with the evolving nature of threats.

- EDR/XDR: EDR and XDR stay top-of-mind for addressing endpoint threats.

It’s noteworthy that regardless of the in depth checklist of subjects safety professionals must hold abreast of, DLP and knowledge safety administration are surprisingly ranked decrease in precedence. Furthermore, roughly 30% of respondents haven’t any speedy plans to evaluate their knowledge safety administration methods. This might recommend a regarding complacency or a spot in recognizing the important significance of sturdy knowledge safety practices amidst the fast-evolving digital risk panorama. Such findings inform us there’s a necessity for continuous training and technique reassessment to make sure complete safety throughout all organizational knowledge contact factors.

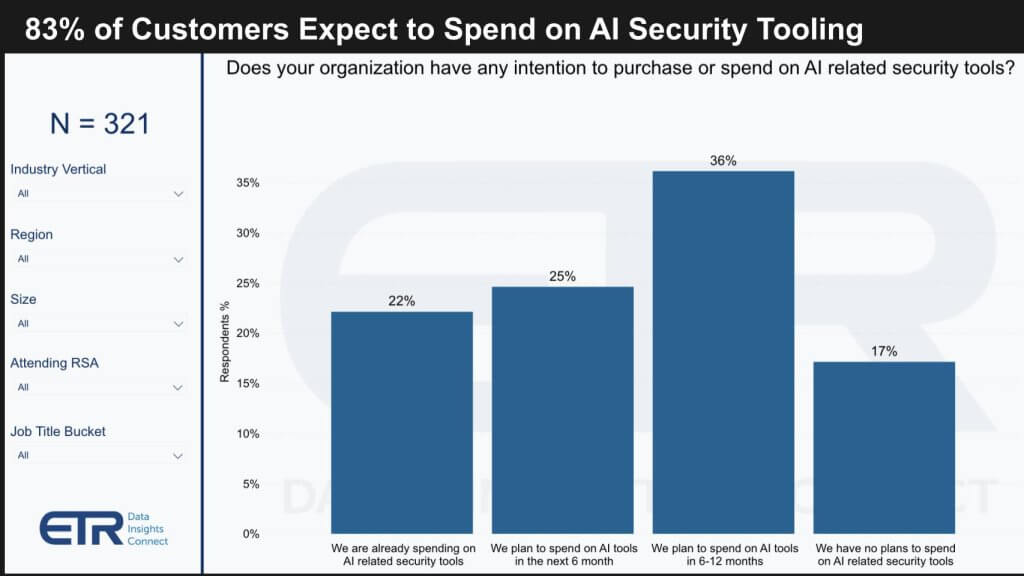

Double-clicking on AI safety spending patterns

Our evaluation of the most recent survey knowledge gives insights into the present and future spending traits on AI safety instruments. The findings recommend that AI’s function in safety is increasing quickly, with:

- 22% of respondents at present allocating price range to AI-related safety instruments.

- An extra 25% planning to direct funds towards such instruments throughout the subsequent six months, indicating a big shift in spending patterns more likely to materialize earlier than RSA 2025.

- A notable 17% reported no plans to spend on AI-specific safety instruments, which may very well be indicative of a development the place AI is anticipated to be a built-in characteristic fairly than a standalone funding.

Though a small phase signifies no deliberate expenditure on AI-specific instruments, the broader development highlights a considerable dedication to AI within the safety area. The intent behind the query within the ETR survey was particularly geared towards web new investments in AI instruments fairly than incidental spending on embedded AI options inside current merchandise.

Further ETR knowledge not displayed above reveals that:

- The bulk (47%) at present make the most of AI in only one% to 10% of their safety instruments.

- An extra 26% have AI embedded in about 10% to 25% of their instruments.

- A smaller group, 14%, reported that greater than 1 / 4 of their safety instruments already incorporate AI capabilities.

These figures underscore a comparatively low baseline of current AI integration, suggesting appreciable progress potential for AI software in safety instruments. With the vast majority of respondents planning to speculate, the panorama of AI-enabled safety instruments is poised for important progress in our view, reflecting each a requirement for superior safety measures and the rising significance of AI in addressing advanced safety challenges, significantly the dearth of certified human labor. Furthermore, as attackers more and more use AI to penetrate organizations, AI will likely be of accelerating significance to cease and detect breaches and take remedial motion.

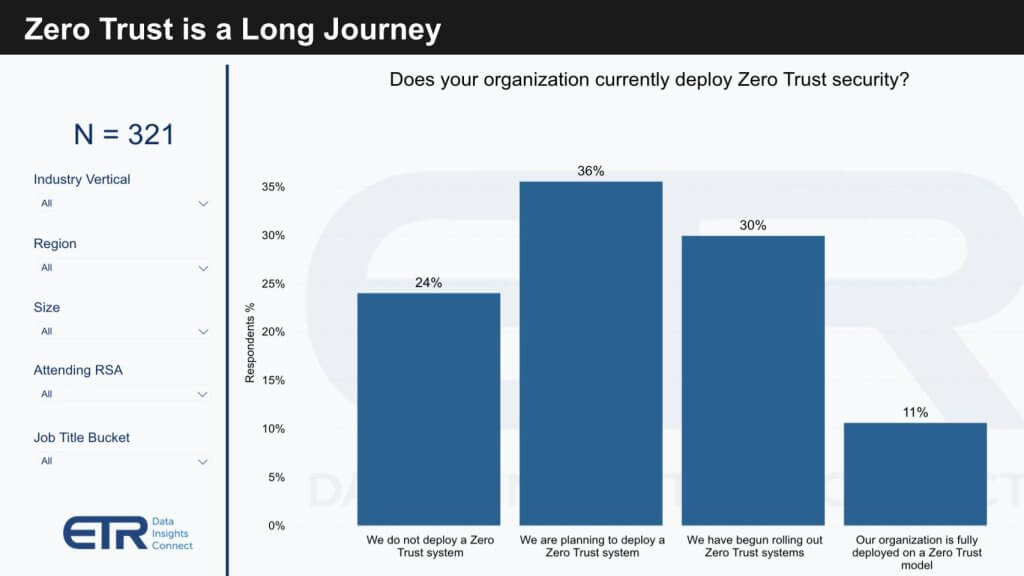

Constructing a zero-trust structure takes time

The business narrative round zero-trust architectures reveals a spot between market hype and the on-the-ground actuality seen by safety practitioners. Though zero belief is receiving justified consideration, its implementation is advanced and multifaceted. Among the many surveyed CISOs, there’s a clear drive to undertake zero-trust methodologies, however a number of hurdles stay:

- Strategic and regulatory alignment: Navigating the intersection of zero-trust rules with regulatory compliance and company insurance policies.

- Technical challenges: Addressing intricate technical necessities corresponding to microsegmentation and ever-changing authentication mechanisms.

- Analytics: The necessity for sturdy measurement and analytics to evaluate the efficacy of zero-trust initiatives repeatedly.

- Organizational hurdles: The operational elements, together with funding, proof of idea levels, testing and alter administration.

Regardless of these challenges, our findings recommend an encouraging development towards adoption:

- Zero-trust deployment: A shocking 11% of organizations have totally deployed a zero-trust mannequin, indicating progress in transferring from principle to follow.

- Zero-trust pathway: Greater than three-fourths of respondents are in some part of the zero-trust journey, both having begun the method or planning to take action.

Apparently, there’s a notable discrepancy in perceptions between job roles relating to the deployment of zero belief:

- Practitioners versus executives: 15% of practitioners declare full deployment, practically double the 8% acknowledged by C-suite executives.

This distinction in notion highlights a communication hole inside organizations relating to the standing of zero-trust implementation. Total, the panorama for zero belief remains to be evolving, with the vast majority of entities recognizing its worth and actively transferring towards it, signifying a big future progress space in safety structure.

TheCUBE Analysis and ETR at RSA: What we’re monitoring

TheCUBE as soon as once more will likely be broadcasting dwell from Moscone West at RSA. Our program spans 4 days of protection with main practitioners, analysts, business CEOs and thought leaders. All of the motion will be discovered right here on theCUBE’s dwell broadcast website and on SiliconANGLE.

At RSA, we may also interact straight with the cybersecurity group, attending varied occasions, corresponding to a cocktail occasion SiliconANGLE is internet hosting alongside the New York Inventory Change, OpenPolicy and Intel Capital, and collaborating with corporations corresponding to Elastic. We eagerly anticipate these interactions as a possibility to additional our understanding and assess the heartbeat of the business.

As we sit up for RSA 2024, our focus will likely be on quite a lot of important developments and dynamics throughout the cybersecurity area. Key factors of curiosity embrace:

- Safety spending patterns: Understanding how these are evolving and correlating with the information we’ve shared is paramount.

- AI funding: Investigating how organizations are financing AI improvements amidst the necessity to keep operational stability. With round 42% of organizations redirecting funds from different budgets to fund AI, the implications for enterprise strains and IT are important.

- Safety software sprawl: Delving into the administration of this sprawl is essential, significantly given prevailing narrative across the matter. The validity of the ETR knowledge is one thing we stand by, because of ETR’s meticulous vetting processes and shut relationships with respondents, which stay nameless and guarded.

- SecOps analyst expertise: Exploring how AI can probably streamline the advanced roles of safety professionals, who are sometimes in comparison with air visitors controllers of their stress and necessity for precision.

- Vendor narrative versus market actuality: Testing the prevalent consolidation narrative in opposition to precise market behaviors to discern the true state of cybersecurity business traits.

Our presence at Moscone West in Media Row affords a primary location for networking and sharing insights. We invite attendees to hitch us for these discussions, and we stay up for the productive exchanges that RSA all the time facilitates, connecting know-how suppliers, end-users and traders alike. As all the time, the convergence of views at RSA gives a complete snapshot of the present state and future path of cybersecurity.

See you there!

Your vote of help is necessary to us and it helps us hold the content material FREE.

One click on under helps our mission to supply free, deep, and related content material.

Be a part of our group on YouTube

Be a part of the group that features greater than 15,000 #CubeAlumni consultants, together with Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and lots of extra luminaries and consultants.

THANK YOU

[ad_2]