[ad_1]

Monetary literacy isn’t simply a type of issues that occurs by chance, we both be taught it from somebody within the know or we be taught it the exhausting means, from an empty checking account. So it may be useful to listen to the tales of different’s errors to keep away from them ourselves.

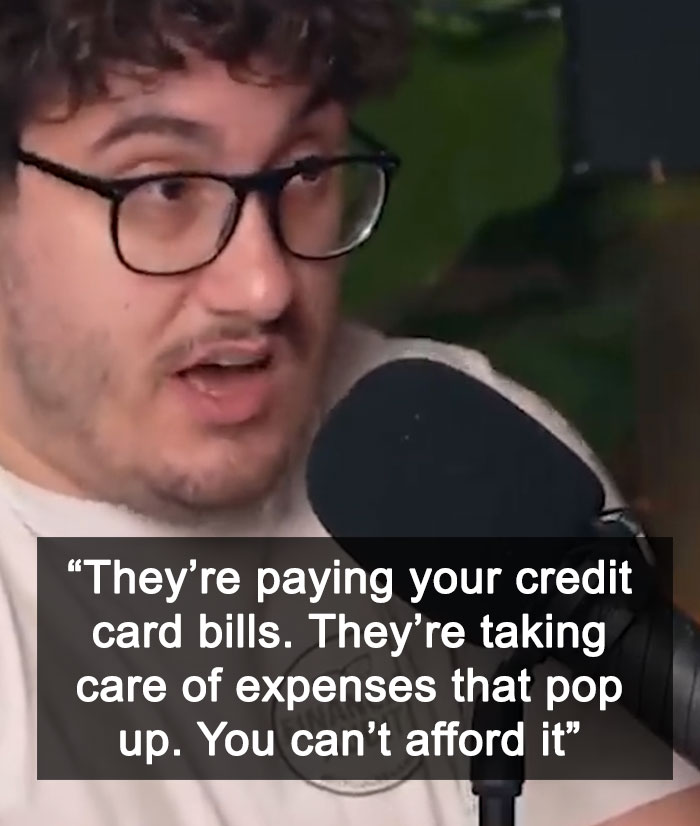

Monetary recommendation blogger Caleb Hammer went viral on TikTok after interviewing a twenty-year-old who ended up hundreds in debt after she didn’t perceive the distinction between credit score restrict and debt. We reached out to Caleb through e mail and can replace the article when he will get again to us.

Extra data: TikTok

Bank cards may not be essentially the most intuitive issues to know for an adolescent

Picture credit: Tima Miroshnichenko / pexels (not the precise picture)

However one twenty-year-old didn’t know the distinction between a credit score restrict and debt, ending up within the latter

Picture credit: calebhammercomposer

Rylie: With my bank card, I maxed that out to $4,000.

Caleb: What do you imply you maxed it out? Max it out or maxed it out?

Rylie: I bought confused with the credit score debt and the credit score restrict. So my mother and father bought me a bank card. And I ended up getting a max credit score restrict of $8,000. So I might spend as much as $8,000. That’s what which means, proper? So I might use it and I might take my boyfriend, we’d exit, me, my pals, we’d exit and I’d pay for everyone. ‘I bought it. Oh, I’ll spend the cash, don’t fear about it, it’s only a bank card.’ So I might pay and pay and pay and pay. After which I referred to as my mother sooner or later, and I needed her to be happy with me. So I used to be similar to, ‘Hey, I’ve bought $4,000 credit score on my bank card.’ And he or she’s like, ‘Credit score restrict or credit score debt?’ I used to be like, ‘What’s debt?’ And he or she’s like, ‘Oh, that’s dangerous.’ I’m like, ‘Oh, actually? Okay. So it’s $4,000 debt, then.’ She’s like, ‘That’s dangerous. Why did you do this?’ I’m like, ‘I believed that was good.’ She’s like, ‘No, your credit score restrict on the time was $8,000.’ So I used to be like, ‘Okay, properly, the credit score restrict is $8,000. That’s good, proper?’ And he or she’s like, ‘Sure, however you might be $4,000 in debt.’

Picture credit: calebhammercomposer

Caleb: When was this?

Rylie: Final yr.

Caleb: Okay, after which what?

Rylie: After which they’re like, ‘Screw it, you’re not gonna pay this off in time. Give it to me.’ So my mother and father took it they usually’re nonetheless presently paying it off proper now.

Rylie: They’ve been paying it off from $4,000. They simply mainly gave up and stated ‘You’re not gonna pay this in time. You’re transferring out and you’ve got a $4,000 bank card, you’re not going to pay that off in time, you’re gonna get so overwhelmed. So simply give it to me. After which we’ll pay it. After which at any time when…’

Picture credit: calebhammercomposer

Caleb: Hear, I don’t need you to endure in debt. However is that serving to you? Is that educating you? I don’t suppose so. I believe they’re achieved. You get it to zero, and over the subsequent couple of years, possibly even if you begin making more cash and your life-style, inflate your self, you simply deliver it proper as much as the $12,500. That seems like some type of enablement to me.

Rylie: Nicely, I imply, they stated, ‘At any time when we pay it off, over time, you may pay us again that $4,000.’ I’m like, okay, cool. After which like, ‘Nicely, we’re gonna maintain it, however in the event you need assistance with like one thing together with your automobile, or together with your cat or together with your canine or one thing, you may simply ask us for it. And you should use it, after which you may pay that off.’

Caleb: Why are they similar to funding [your life]… You generate income?

Rylie: Yeah.

Caleb: The place’s the cash going the place you may’t care for your self as an grownup? You needed to maneuver out, like an grownup.

Rylie: Yeah.

Caleb: However you need to depend on them taking good care of you? I’m confused. Why can’t you care for your personal s**t?

Rylie: Nicely, I can. I can. I imply…

Caleb: Then why don’t you?

Rylie: I do, I do. I imply, if…

Caleb: Not from every thing you simply stated…

Picture credit: calebhammercomposer

Rylie: My hire presently is $1,400, one thing like that.

Caleb: That’s insane, you may’t afford to stay. You may’t afford to exit.

Rylie: Sure, I can.

Caleb: No, you may’t! The earnings that got here in was $1,600, hire is $1,400. That’s not ‘affording.’ That’s your wants, 80%.

Rylie: Woman math.

Caleb: This isn’t a joke.

Rylie: I’m not treating it as a joke.

Caleb: *It’s woman math.* Math math says it’s about 80% of your earnings.

Rylie: Yeah, I imply, we get earnings from different methods too.

Picture credit: calebhammercomposer

Caleb: Okay, I noticed $128 got here in from Lackland. And $263 got here in from Money App. So $2,000. So even nonetheless, your hire of what, once more?

Rylie: Nearly $1,400

Caleb: Okay. Okay. It’s 70%. You can not afford it. It shouldn’t be larger than 30%.

Rylie: Nicely, what I do is I am going donate on the facet, too.

Rylie: But when like for no matter cause, like I really feel like we’re low, a couple hundred {dollars} on hire, we’ll go donate for the primary couple days earlier than hire’s due, we’ll seize the cash.

Picture credit: calebhammercomposer

Caleb: No offense, you could possibly not transfer out.

Rylie: I did although.

Caleb: Yeah, however you’re not affording it. And don’t say ‘I’m affording it,’ as a result of I’ll let you know the way you’re not affording it. They’re paying your bank card payments. They’re taking good care of bills that pop up. You may’t afford it. You’re being enabled.

Rylie: I’m not being enabled.

Caleb: Sure. As a result of your cash goes to f**ok you.

You may watch the complete video right here

@calebhammercomposer 20 Yr Previous Doesn’t Know What DEBT MEANS!!! 🤦♂️🤬 #financialaudit ♬ unique sound – Caleb Hammer

Younger adults are inclined to have the worst monetary literacy round

As a lot as cash “runs the world,” many individuals are inclined to do not know the right way to act once they get entry to it. To this younger lady’s credit score, her first impulse was misguided generosity, though it’s price noting that on this case, it’s not precisely her cash. Whereas it might sound ridiculous that the girl being interviewed believed {that a} credit score restrict is free cash, analysis means that younger individuals usually have the lowest monetary literacy amongst all age cohorts.

Partially, this may be seen because of some social taboos round discussing cash. Whereas, opposite to the numerous memes on the market, many faculties do train some about taxes and funds, that is all very summary till the younger grownup has cash in hand. How they spend it’s typically a mirrored image of what they’ve seen their mother and father do. Some mother and father spend so much as a result of they’re financially secure, others are frugal, however with out clear explanations of why they do what they do, their children don’t precisely be taught any new classes.

Nonetheless, usually, most adults don’t precisely focus on their monetary choices with their kids and preserve a really totally different degree of earnings. Whereas it may be simple to mock somebody for having no thought what a credit score restrict is, it may additionally be price questioning why her mother and father gave her a bank card with out really explaining the way it works.

There are even organizations that prey on unwitting younger of us

A scarcity of monetary literacy isn’t just a few buzzword or summary idea, it will possibly typically be measured in real-world impacts. For instance, many younger adults, like the girl on this clip, find yourself in debt that’s realistically disproportionate to their earnings. The actual fact is that past easy misunderstandings about bank cards, there are predatory monetary establishments that particularly supply “simple” loans to gullible of us who need an on the spot dose of retail remedy, leaving them in horrible debt for a very long time. It’s not a rip-off if a prepared and “knowledgeable” grownup signed off on it.

Equally, as soon as an individual is eighteen, they will gamble in most areas, one thing betting corporations and casinos know very properly. Technically, the chances are at all times “clear” however fashionable tradition has typically obfuscated simply how intoxicating betting might be, main individuals to throw their cash away.

One instance of this, not less than within the US, are the ever-discussed pupil loans. Individuals who would by no means qualify for a “regular” mortgage find yourself straddled with debt that they repay for many years to return. There’s a section of society that also blames the loan-takers, however realistically, if we perceive that statistically a lot of them don’t fairly perceive what they’re stepping into, can we really maintain them accountable?

Viewers shared their opinions

[ad_2]