[ad_1]

CoreWeave Inc. is holding talks a few new funding spherical that might worth it at $16 billion, Bloomberg reported right this moment.

That sum is greater than double what the corporate was value in December and would characterize an eightfold improve over its April valuation. Bloomberg’s sources didn’t specify how a lot capital CoreWeave might increase or from whom. However they did reveal that the corporate plans to supply each new and current shares, which suggests traders could have a chance to promote their stakes.

Roseland, New Jersey-based CoreWeave launched in 2017 as a cryptocurrency mine operator. It used Nvidia Corp. graphics processing models to mint Ethereum. A number of years later, it shifted to renting these GPUs to builders constructing synthetic intelligence fashions.

The corporate operates a cloud platform optimized particularly for AI workloads. In keeping with the corporate, prospects can select from a few dozen completely different Nvidia chips. Probably the most highly effective occasion configuration on provide combines eight high-end H100 graphics playing cards, which reportedly value as much as $40,000 apiece, with a pair of Intel Corp. central processing models and a couple of terabytes of RAM.

CoreWeave additionally supplies entry to different sorts of {hardware} in addition to GPU servers. It presents a number of situations that solely embrace CPUs and are geared towards general-purpose workloads reasonably than AI fashions. Moreover, it supplies bare-metal servers for functions that may’t be simply packaged into software program containers.

Prospects can retailer their workloads’ information in a storage service that features a so-called triple replication function. CoreWeave spreads copies of every buyer report throughout a number of server racks, in addition to a number of machines inside these racks. This association ensures that the info stays obtainable if one of many servers goes offline.

Underneath the hood, the platform is powered by Kubernetes. It makes use of a community with a built-in load balancer to maneuver information between prospects’ GPU situations, in addition to from these situations to providers deployed on exterior infrastructure. The load balancer evenly distributes incoming visitors amongst an organization’s GPU situations to optimize efficiency.

At the beginning of 2023, CoreWeave hosted its cloud platform in two information facilities. The corporate raised $221 million in April of that yr and went on to construct a dozen further cloud services. Final December, it offered one other $642 million value of share to an investor consortium that included Constancy Administration and JPMorgan Asset Administration.

The extra funding might allow the corporate to additional broaden its information middle community. All 14 of the cloud services it at present operates are in North America. Utilizing a contemporary capital infusion, CoreWeave might set up information facilities in additional areas to broaden its addressable market.

The corporate would possible additionally use any new funding it raises to obtain Nvidia’s newest Blackwell B200 graphics card. It’s estimated that the chip supplies 5 occasions the efficiency of the H100, probably the most superior Nvidia graphics card that CoreWeave at present presents. Its rivals within the AI infrastructure market, corresponding to newly funded startup Collectively Laptop Inc., are additionally prone to undertake the chip.

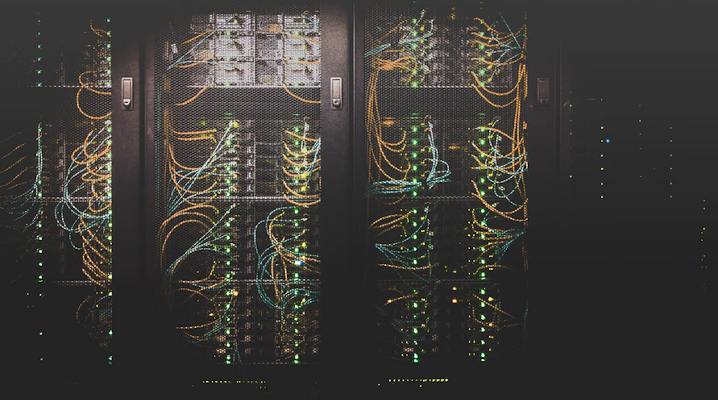

Picture: Unsplash

Your vote of help is necessary to us and it helps us maintain the content material FREE.

One click on beneath helps our mission to supply free, deep, and related content material.

Be part of our neighborhood on YouTube

Be part of the neighborhood that features greater than 15,000 #CubeAlumni specialists, together with Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and lots of extra luminaries and specialists.

THANK YOU

[ad_2]